- Study

- Slides

- Videos

9.1 Introduction To Margins

Just as we are faced with day to day uncertainties pertaining to weather, health, traffic etc and take steps to minimize the uncertainties, so also in the stock markets, there is uncertainty in the movement of share prices.

This uncertainty leading to risk is sought to be addressed by margining systems of stock markets. Suppose an investor, purchases 10,000 shares of ‘abc’ company at Rs.300/- on January 1, 2022. Investor has to give the purchase amount of Rs.30,00,000/- (10000 x 300) to his broker on or before January 2, 2022. Broker, in turn, has to give this money to stock exchange on January 3, 2022.

There is always a small chance that the investor may not be able to bring the required money by required date. As an advance for buying the shares, investor is required to pay a portion of the total amount of Rs.30,00,000/- to the broker at the time of placing the buy order. Stock exchange in turn collects similar amount from the broker upon execution of the order. This initial token payment is called margin.

Remember, for every buyer there is a seller and if the buyer does not bring the money, seller may not get his / her money and vice versa. Therefore, margin is levied on the seller also to ensure that he / she gives the 10000 shares sold to the broker who in turn gives it to the stock exchange. Margin payments ensure that each investor is serious about buying or selling shares.

Example-

In the above example, assume that margin was 15%. That is investor has to give Rs.4,50,000/-(15% of Rs.30,00,000/) to the broker before buying. Now suppose that investor bought the shares at 11 am on January 1, 2022. Assume that by the end of the day price of the share falls by Rs.50 -. That is total value of the shares has come down to Rs.25,00,000/-. That is buyer has suffered a notional loss of Rs.2,50,000/-. In our example buyer has paid Rs.4,50,000/- as margin but the notional loss, because of fall in price, is Rs.500000/-. That is notional loss is more than the margin given.

In such a situation, the buyer may not want to pay Rs.30,00,000/- for the shares whose value has come down to Rs.25,00,000/-. Similarly, if the price has gone up by Rs.50/-, the seller may not want to give the shares at Rs.30,00,000/-. To ensure that both buyers and sellers fulfill their obligations irrespective of price movements, notional losses are also need to be collected.

Prices of shares keep on moving every day. Margins ensure that buyers bring money and sellers bring shares to complete their obligations even though the prices have moved down or up.

9.2 Mark To Market Margin

In the futures market, all trades happen through an exchange. The exchange in return takes the guarantee of settling all the trades. By guarantee, it means the exchange makes sure you get your money if you are entitled. This also means they ensure they collect the money from the party who is supposed to pay up.

So how does the exchange make sure this works seamlessly? Well, they make this happen using –

- Collecting the margins

- Marking the daily profits or losses to market (also called M2M)

Concept of margin we have already understood. Now lets understand the process of M2M. Mark to Market is a process in which gains and losses are settled on each trading day. This means that the value of the contract is marked to its current market value.

Basically, MTM is calculated at the end of the day on all open positions by comparing transaction price with the closing price of the share for the day. For example, Lets assume that the buyer purchased 100 shares @ Rs.100/- at 11 am on January 1, 2022. If close price of the shares on that day happens to be Rs.75/-, then the buyer faces a notional loss of Rs.25,000/ – on his buy position. In technical terms this loss is called as MTM loss and is payable by January 2, 2008 (that is next day of the trade).

In case price of the share falls further by the end of January 2, 2008 to Rs. 70/-, then buy position would show a further loss of Rs.5,000/-. This MTM loss is payable.

In case, on a given day, buy and sell quantity in a share are equal, that is net quantity position is zero, but there could still be a notional loss / gain (due to difference between the buy and sell values), such notional loss also is considered for calculating the MTM payable.

Example of Daily Calculation of MTM

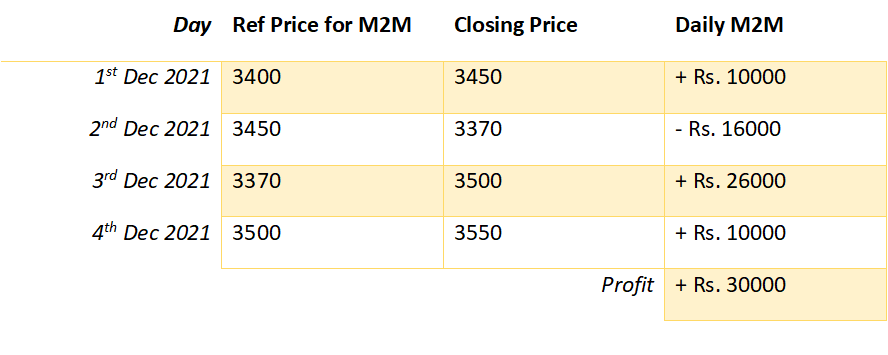

Assume on 1st Dec 2021 at around 11:30 AM; you decide to buy Britannia Futures contract at Rs.3400/-. The Lot size is 200. 4 days later, on 4th Dec 2021, you decide to square off the position at 2:15 PM at Rs.3500/-. This a profitable trade –

Buy Price = Rs.3400

Sell Price = Rs.3550

Profit per share = (3550 –3400) = Rs.150/-

Total Profit = 150 * 200

= Rs.30000/-

The trade was held for 4 working days. Each day the futures contract is held, the profits or loss is marked to market. While marking to market, the previous day closing price is taken as the reference rate to calculate the profit or losses.

The table above shows the futures price movement over the 4 days the contract was held. Lets understand how things happen on a day to day basis to understand how M2M works

On Day 1 at 11:30 AM, the futures contract was purchased at Rs.3400, clearly after the contract was purchased, the price has gone up further to close at Rs.3450. Hence profit for the day is 3450 minus 3400 = Rs.50 per share. Since the lot size is 200, the net profit for the day is 50*200 = Rs.10000.

Hence the exchange ensures (via the broker) that Rs.1000 is credited to your trading account at the end of the day.

1. But where is this money coming from?

Obviously, it is coming from the counterparty. Which means the exchange is also ensuring that the counterparty is paying up Rs.1000/- towards his loss

2. But how does the exchange ensure they get this money from the party who is supposed to pay up?

Obviously, through the margins that are deposited at the time of initiating the trade.

Another important aspect from an accounting perspective, the futures buy price is no longer treated as Rs.3400 but instead, it will be considered as Rs.3450 (closing price of the day). Why is that so, you may ask? The profit earned for the day has been given to you already using crediting the trading account. So you are fair and square for the day, and the next day is considered a fresh start. Hence the buy price is now considered at Rs.3450, which is the closing price of the day.

On day 2, the futures closed at Rs.3370, which is a loss. The day’s loss would be (3370-3450) i.e. Rs.80 per share or Rs.16000 net loss. The loss that you are entitle to bear is debited from your trading account, and the buy price is reset to the day’s closing price, i.e. 3370.

On day 3, the futures closed at Rs.3500 which means that there is a profit of Rs.26000 (3500 – 3370* 200). The profit will get credited to your account. Also, the buy price is now reset to Rs.3500.

On day 4, the trader did not continue to hold the position through the day but rather decided to square off the position mid-day 2:15 PM at Rs.3550. Hence concerning the previous day’s close, he again made a gain. That would be 3550-3500 Rs.50 *200= Rs.1000. Needless to say, after the square off, it does not matter where the futures price goes as the trader has squared off his position.

Tabular summary of the same –

9.3 Other Margins In Derivatives Segment

Margins on both Futures and Options contracts comprise of the following:

1) Initial Margin

2) Exposure margin

In addition to these margins, in respect of options contracts the following additional margins are collected:

1) Premium Margin

2) Assignment Margin

Initial Margin Calculation

Initial margin for F&O segment is calculated on a portfolio (a collection of futures and option positions) based approach. The margin calculation is carried out using a software called – SPAN (Standard Portfolio Analysis of Risk). It is a product developed by Chicago Mercantile Exchange (CME) and is extensively used by leading stock exchanges of the world.

SPAN uses scenario-based approach to arrive at margins. Value of futures and options positions depend on, among others, price of the security in the cash market and volatility of the security in cash market. As you would agree, both price and volatility keep changing.

To put it simply, SPAN generates about 16 different scenarios by assuming different values to the price and volatility. For each of these scenarios, possible loss that the portfolio would suffer is calculated. The initial margin required to be paid by the investor would be equal to the highest loss the portfolio would suffer in any of the scenarios considered. The margin is monitored and collected at the time of placing the buy / sell order.

The SPAN margins are revised 6 times in a day – once at the beginning of the day, 4 times during market hours and finally at the end of the day. Obviously, higher the volatility, higher the margins.

Exposure Margin Calculation

In addition to initial / SPAN margin, exposure margin is also collected. Exposure margins in respect of index futures and index option sell positions is 3% of the notional value.

For futures on individual securities and sell positions in options on individual securities, the exposure margin is higher of 5% or 1.5 standard deviation of the LN returns of the security (in the underlying cash market) over the last 6 months period and is applied on the notional value of position.

Premium & Assignment Margin Calculation

In addition to Initial Margin, a premium margin is charged to buyers of option contracts. The premium margin is paid by the buyers of the options contracts and is equal to the value of the options premium multiplied by the quantity of options purchased.

For example, if 1000 call options on ABC Ltd are purchased at Rs. 20/-, and the investor has no other positions, then the premium margin is Rs. 20,000. The margin is to be paid at the time trade. Assignment Margin is collected on assignment from the sellers of the contracts.