- Study

- Slides

- Videos

2.1 Meaning Of Derivatives Market

The derivatives are most modern financial instruments for hedging risk. The individuals and firms who wish to avid or reduce risk can deal with the others who are willing to accept the risk for a price. A common place where such transactions take place is called the derivative market.

Initially, derivative started in an unorganized market. But, now, there exists an organized market as well. Organized market does not mean undeveloped market. It refers to over the counter market, in which the buyers and sellers come in contract directly with each other or through an intermediary. They mutually decide about all the terms and conditions of the contract and both commit to fulfil and abide by the set of terms. Thus derivative market is a market in which derivatives are traded. In short, it is a market for derivatives. The traders in the derivative markets are hedgers, speculators and arbitrageurs.

2.2 Functions Of Derivatives Markets

- Discovery of price: Prices in an organized derivatives market reflect the perception of market participants about the future and lead the prices of underlying assets to the perceived future level. The prices of derivatives converge with the prices of the underlying at the expiration of the derivative contract. Thus derivatives help in discovery of future as well as current prices.

- Risk transfer: The derivatives market helps to transfer risks from those who have them but may not like them to those who have an appetite for them.

- Linked to cash markets: Derivatives, due to their inherent nature, are linked to the underlying cash markets. With the introduction of derivatives, the underlying market witnesses higher trading volumes because of participation by more players who would not otherwise participate for lack of an arrangement to transfer risk.

- Check on speculation: Speculation traders shift to a more controlled environment of the derivatives market. In the absence of an organized derivatives market, speculators trade in the underlying cash markets. Managing, monitoring and surveillance of the activities of various participants become extremely difficult in these kind of mixed markets.

- Increases savings and investments: Derivatives markets help increase savings and investment in the long run. The transfer of risk enables market participants to expand their volume of activity.

2.3 Participants In The Derivatives Markets

Hedgers

Hedgers are traders who wish to protect themselves from the risk involved in price movements. They look for opportunities to pass on this risk to those who are willing to bear it. They are so keen to rid themselves of the uncertainty associated with price movements that they may even be ready to do so at a predetermined cost. For instance, let's say that you possess 200 shares of company Britannia Ltd. and the price of these shares is hovering at around Rs 3400 at present. Suppose you plan to sell these shares near to Diwali and wish to utilise the funds to purchase some consumer goods during the season, as you are likely to get a good deal on the purchase then. However, since Diwali is around a month from today, you fear that the price of these shares could fall considerably by then. At the same time you do not want to encash your investment today as you may fritter away the money before Diwali. You are very clear about the fact that you would like to receive a minimum of Rs 3400 per share and no less. At the same time, in case the price rises above Rs 3400, you would like to benefit by selling them at the higher price. By paying a small price, you can purchase an arrangement in the form of a derivative product called an 'option' that incorporates all your above requirements.

Thus, the derivative market offers products that allow you to hedge yourself against a fall in the price of shares that you possess. It also offers products that protect you from a rise in the price of shares that you plan to purchase. And that's only the tip of the iceberg. There are a wide variety of products available and strategies that can be constructed which allow you to pass on your risk to other market traders, who are more than willing to take it on.

Speculators

These are risk-takers of the derivative market. They want to embrace risk in order to earn profits. They have a completely opposite point of view as compared to the hedgers. This difference of opinion helps them to make huge profits if the bets turn correct.

Speculators, unlike hedgers, look for opportunities to take on risk in the hope of making returns.

Let's go back to our example, wherein you were keen to sell share of Britannia Ltd. after one month, but feared that the price would fall below your threshold price. In the derivative market, there will be a speculator who expects the market to rise. Accordingly, he will enter into an agreement with you stating that he will buy shares from you at Rs 3400 if the price falls below that amount. In return for this risk that he will relieve you off, he must be paid a small compensation. He realises that if his surmise is correct, and the price of Britannia Ltd rises, you will not want to sell shares to him anymore and he will get to pocket this compensation. This is only one instance of how a speculator could gain from a derivative product. For every opportunity that the derivative market offers a risk-averse hedger, it offers a counter opportunity to a trader with a healthy appetite for risk.

In the Indian markets, there are two types of speculators - day traders and the position traders. A day trader tries to take advantage of intra day fluctuations and the up and down movement in prices. They do not leave any position open at the end of the day, i.e., they do not have any overnight exposure to the markets. On the other hand, position traders greatly rely on news, tips and technical analysis (the science of predicting trends and prices) and take a longer view, say a month, in order to realise better profits.

Arbitrageurs

These utilize the low-risk market imperfections to make profits. They simultaneously buy low-priced securities in one market and sell them at a higher price in another market. This can happen only when the same security is quoted at different prices in different markets. Suppose an equity share is quoted at Rs 1000 in the stock market and at Rs 1050 in the futures market. An arbitrageur would buy the stock at Rs 1000 in the stock market and sell it at Rs 1050 in the futures market. In this process, he/she earns a low-risk profit of Rs 50.

This is because in the Indian markets, there is no delivery of shares in order to settle positions in the derivatives segment; the cash and future prices converge on the expiry day, and a trader merely pays or receives the difference between his purchase price and the price prevailing in the cash market on the day the contract expires.

Margin Traders

Margin traders are speculators who make use of the payment mechanism, which is peculiar to the derivative markets. When you trade in derivative products, you are not required to pay the total value of your position up front. You are only required to deposit a fraction (called margin) of the value of your outstanding position. This is called margin trading and results in a high leverage factor in derivative trades, i.e., with a small deposit, you are able to maintain a large outstanding position. This leverage factor is a multiplier, which allows the speculator to buy three to five times the quantity that his capital investment would otherwise have allowed him to buy in the cash market.

For example, let's say a sum of Rs 1.8 lakh fetches you 180 shares of XYZ Ltd. in the cash market at the rate of Rs 1,000 per share. Under margin trading in the derivatives market, if you are required to deposit a margin of say 30 per cent of the value of your outstanding position, you would be able to purchase 600 shares of the same company at the same price, with your capital of Rs 1.8 lakh i.e., Rs 1.8 lakh / (30 per cent of Rs 1000) = 600 shares. So, in effect, you are allowed a leverage of 3.33 times in this case (100/30). If the price of XYZ Ltd. rises by Rs 100, your 180 shares in the cash market will deliver a profit of Rs 18,000, which would mean a return of 10 per cent on your investment. However, your payoff in the derivatives market would be much higher. The same rise of Rs 100 in the derivative market would fetch Rs 60,000, which translates into a whopping return of over 33 per cent on your investment of Rs 1.8 lakh. This is how a margin trader, who is basically a speculator, benefits from trading in the derivative markets.

2.4 Difference Between Cash Market and Derivative Market

- Ownership: - When you buy shares in the cash market and take delivery, you are the owner of these shares or you are a shareholder, until you sell the shares. You can never be a shareholder when you trade in the derivatives segment of the capital market. This is because you just hold positional stocks, which you have to square-off at the end of the settlement.

- Holding Period: - When you buy shares in the cash segment, you can hold the shares for life. This is not true in the case of the futures market, where you have to settle the contract within three months at the very maximum. In fact, when you buy shares in the cash segment, they can also be trans-generational, that is they can be transferred from one generation to the other.

- Dividends: - When you buy shares in the cash segment, you normally take delivery and are a owner. Hence, you are entitled to dividends that companies pay. No such luck when you buy any derivatives contract. This is not only true in the case of dividends, but, also other corporate benefits like rights shares, bonus shares etc.

- Risk: - Both, cash and futures markets pose risk, but the risk in the case of futures can be higher, because you have to settle the contract within a specified period and book losses. In the case of shares bought in the cash market, you can hold onto them for an indefinite period and can hence sell when prices are higher.

- Investment Objective Differ: - You buy a contract in the derivatives market to hedge risk or to speculate. Individuals buying shares in the cash market are investors.

- Lots V/s Shares: - In the derivatives segment you buy a lot, while in the cash segment you buy shares.

- Margin Money: - In the derivatives segment you pay only margin money for example, if you buy 1 lot of Punjab National Bank (4000 shares) you just pay 15 to 20 per cent of the cost of the 4,000 shares and not the entire amount. That is not true in the case of cash segment, where you have to pay the entire amount and not only margin.

2.5 Exchange Traded vs OTC Derivative Market

Derivatives have probably been around for as long as people have been trading with one another. Forward contracting dates back at least to the 12th century, and may well have been around before then. Merchants entered into contracts with one another for future delivery of specified number of commodities at specified price. A primary motivation for pre-arranging a buyer or seller for a stock of commodities in early forward contracts was to lessen the possibility that large swings would inhibit marketing the commodity after a harvest.

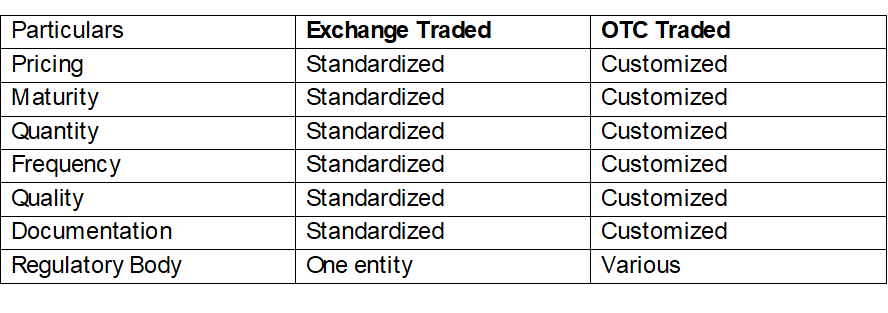

As the word suggests, derivatives that trade on an exchange are called exchange traded derivatives, whereas privately negotiated derivative contracts are called OTC contracts. The OTC derivatives markets have witnessed rather sharp growth over the last few years, which has accompanied the modernization of commercial and investment banking and globalization of financial activities. The recent developments in information technology have contributed to a great extent to these developments. While both exchange-traded and OTC derivative contracts offer many benefits, the former have rigid structures compared to the latter.

Difference Between Exchange Traded and OTC