- Study

- Slides

- Videos

5.1 Going Long

Going long — buying a futures contract — is the most basic futures trading strategy. An investor buys a futures contract expecting the contract to rise in price by expiration.

Best to use when: Buying a futures contract is the most straightforward futures trading strategy for speculating on an asset rising before the contract expires. The futures contract offers a leveraged return on the underlying asset’s rise, so the trader expects a clear move higher in the near future.

Example of a long position- A long futures means a buy position which is due or unsettled as on a particular trade date. For e.g.: suppose X buys 5 Futures contracts on Stock A, then he is stated to have long position on 10 such contracts through which he is able to purchase stock A as per the lot size of the contract.

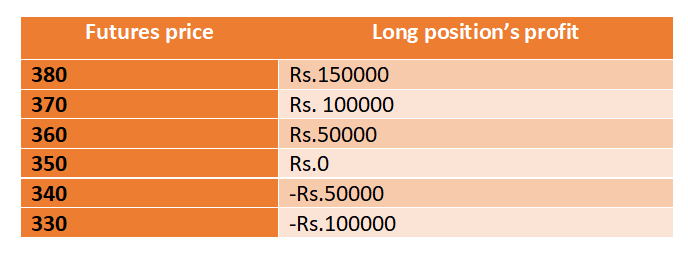

Stock A futures trade at Rs. 350, and you decide to buy 5 contracts of the stock, each containing 1,000 shares. Your broker allows you to have initial margin of 10% on each contract (i.e Rs.35000) and Rs.7000 in maintenance margin. In total, the contracts cost Rs.17.5lk (5* 350 * 1000), but you’ll need only Rs.1.75lk in equity to open the position and Rs.7000 in maintenance margin.

Risks and rewards: Going long offers the inherent promise of the futures contract: a leveraged return on the underlying asset’s rise. It has uncapped upside as long as the asset rises, making this futures trading strategy a potential home run.

Going long also exposes you to leveraged downside. If the underlying asset falls in value, it hits the long futures contract just as hard, and the investor might have to put up more money to hold the position.

5.2 Going Short

Going short-selling a futures contract - is the flip side of going long. An investor sells a futures contract expecting the contract to fall by expiration.

Best to use when: Selling a futures contract is another straightforward futures trading strategy, but it can be riskier than going long because of the potential for uncapped losses if the underlying asset continues to rise. Investors going short on a contract want the full leveraged returns of an asset that is expected to fall.

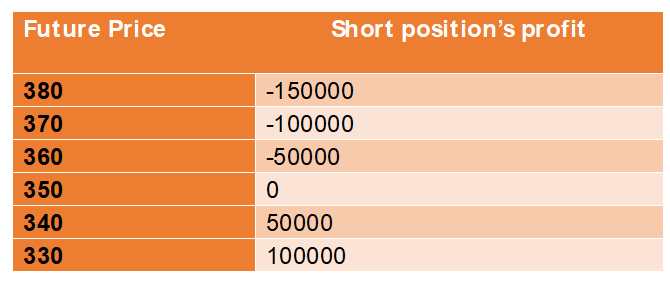

Example of going short: In the above example- short position profit would be

Risks and rewards: Going short offers many of the same benefits that going long does, most notably the leveraged return on the underlying asset’s decline. However, unlike the long position, going short has uncapped downside. Going short exposes you to leveraged upside when the underlying asset falls. But your upside is capped since the underlying asset cannot fall below Rs. 0. In other words, the most you could make on the short contract is the total value of the short position, which is Rs.17.5lk in this example.