- Study

- Slides

- Videos

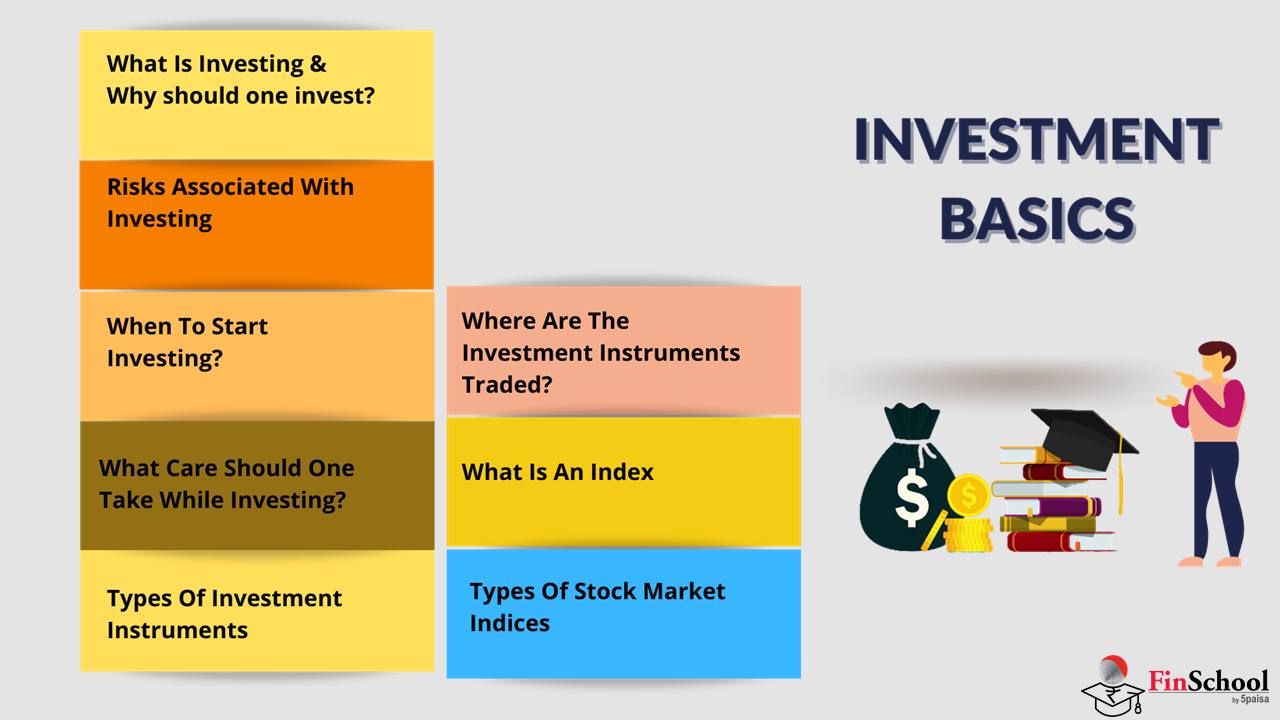

1.1 What Is Investing & Why One Should Invest?

What Is Investing ?

Investing is the process of allocating funds to various financial assets in order to put your money to work and profit from the results. This can serve as a supplemental or, in certain situations, primary source of income, allowing you to achieve your financial objectives. We tend to focus on only a few of the flaws that exist. And, in the end, turn a blind eye to the numerous advantages it delivers.

Why Should One Invest ?

Higher Returns: -

- Investing in the stock market allows you to potentially earn larger returns on your investment. As a result, Investing here allows you to compound your money over time and accumulate wealth for various life goals.

Beats Inflation: -

- Inflation is a significant barrier to wealth building, therefore choosing paths that

outperform inflation is the only way to get wealthy in the long run. Inflation is the

gradual increase in the price levels in a given economy. It eats away at the value of

your investment and your money's purchasing power.

For example- lets say your money is lying idle and kept in the cash vault in your

home- however every year inflation is going up. This essentially means that if

inflation rate is 5%- value of your money will decline by 5% every year if kept idle.

Because the prices of products are going to go up by 5% every year. Thus the longer

you keep your money doing nothing- the more value you erode. Investing in assets

helps you beat inflation and generate some positive returns.

Easy & Flexible: -

- Investing in the stock market isn't difficult. All you need is a methodical approach to long term investing and some background research on the companies you wish to invest in. This can be done by yourself or you could hire a broker to assist you. All one needs is a trading and demat account to get started.

Magic of Compounding: -

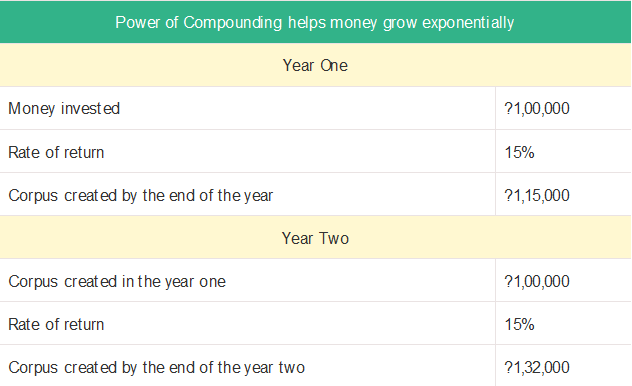

- Warren Buffet started investing at the age of 14, but his money started to grow exponentially when he was 50. Power of compounding is often referred to as the eighth wonder of the world. And here, you must bethinking, what this power of compounding actually means?

- Under the power of compounding, you not only get returns on the money which has been invested but also on the gains. And this way you are able to create a great amount of wealth over a period of time.

- Let us suppose, in one year, you have invested Rs 1 lakh. Its one year returns 15 percent. So by the end of the year, this amount will be Rs 1,15,000. What power of compounding does is, in the next year (assuming the rate of return if 15 percent), it will provide the return on Rs 1,15,000, instead of your original investment of Rs 1 lakh. So, this way, in the second year, you will be getting a return on money that you have invested, and also on the gain from the previous year. By the end of the second year, the amount would be Rs 1 lakh 32 thousand.

- This way power of compounding helps your money grow exponentially.

1.2 Risks Associated With Investing

Many people know they should be investing, but fear of loss keeps them away. After all, nobody wants to lose their hard-earned money, and you often hear warnings about how poor investment decisions can lead to significant losses in the stock market. Some of the biggest risks associated with investing in stocks are:

Volatility

Volatility is a term used to describe the rate of short-term fluctuations in stock prices. Stocks that experience more volatility or a significant movement over a short period of time are considered higher-risk investments, while stocks that experience more slow-and-steady movement are considered lower-risk. Stocks become more volatile when specific events take place. Although volatility reflects the rate at which a stock moves, it does not determine the direction of the movement. In other words, volatility is higher on sharp movements, both up and down.

Timing

The term time is money is nowhere truer than in stock market. Prices move by the second, and pinning down the best time to buy or sell a stock proves to be difficult for experts and retail investors alike. After all, although the goal is to buy low and sell high, without the ability to predict the future, there is no way to tell where low and high sit. Imagine buying a ton of stock when optimism is running high and suddenly the market crashes. Or giving in to panic and selling during a market fall, right before a major rebound begins. Poorly timed investments prove costly.

Returns Not Guaranteed

While stocks have historically performed well over the long term, there is no guarantee you will make money on a stock at any given point in time. Although a number of things can help you assess a stock, no one can predict exactly how a stock will perform in the future. There is no guarantee that prices will go up or that the company will pay dividends or that a company will even stay in business.

1.3 When To Start Investing?

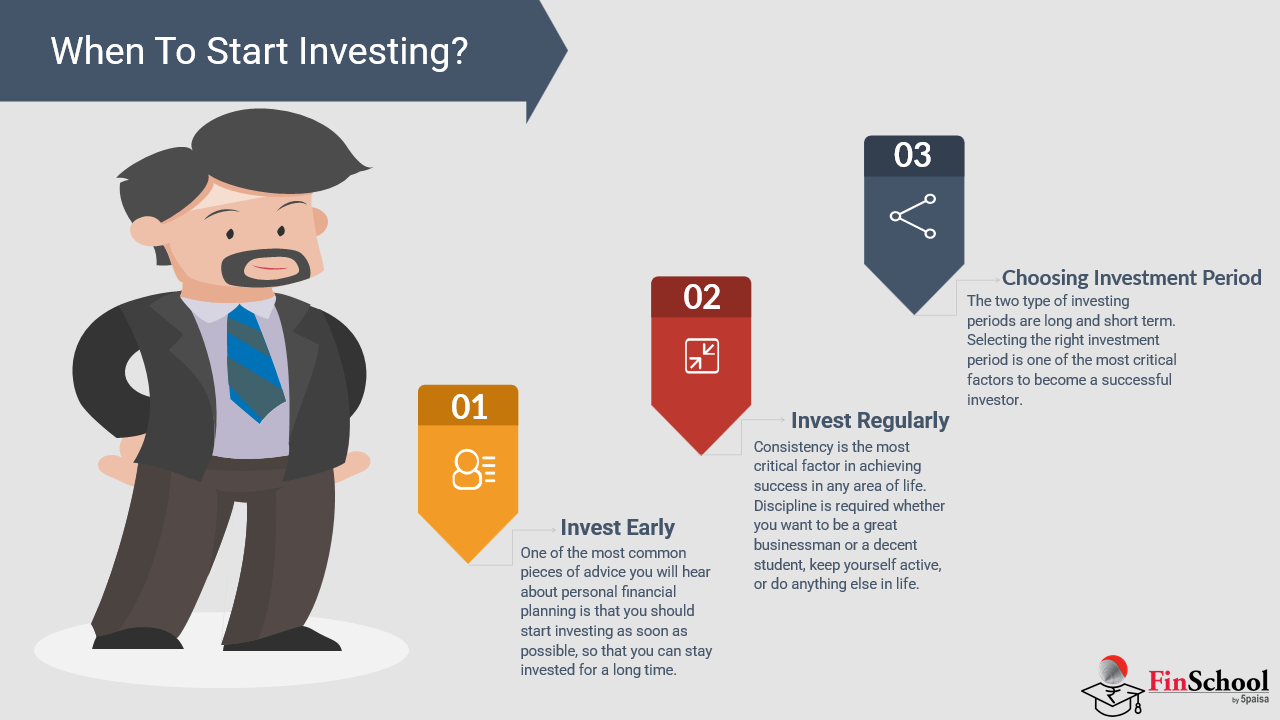

The Three Golden Rules To Remember Before You Start Investing: -

Invest Early

One of the most common pieces of advice you will hear about personal financial planning is that you should start investing as soon as possible, so that you can stay invested for a long time. So, let us understand what are the advantages of investing at an early age, and why is it critical for investors to recognize the significance of doing so at an early age? Is it not fascinating to invest at an early age or when you are a teenager? Yes, but there is more to it apart from just the excitement. The major reason is you give your corpus more time to earn returns if you start early. When you give your invested money more time to generate returns, you effectively give your returns more capability to create more returns. This is known as the power of compounding in technical terms, and it demonstrates that even small investments can provide large returns.

For Example,

For various time periods, Rs. 10,000 was invested monthly at the rate 10%.

3 Years = Rs. 4,17,818

6 Years = Rs. 9,81,113

9 Years = Rs. 17,40,537

The above table shows the importance of Investing at an early stage

Invest Regularly

Consistency is the most critical factor in achieving success in any area of life. Discipline is required whether you want to be a great businessman or a decent student, keep yourself active, or do anything else in life. It applies to many aspects of life, including investment.

Choosing the right type of Investment period (long/short term)

Both types of investments have their own set of advantages and disadvantages. Short-term investing allows you to reach your financial targets in a short period of time while minimizing risk. Long-term investment avenues, on the other hand, are suitable for investors with a greater risk appetite and a desire for better returns.

Summing up, if you are a person who prefers to achieve the small-scale financial goals with minimum risk then short-term investment plan suits you the most.

1.4 What Care Should One Take While Investing?

The rule of thumb is that the higher the risk, the higher the reward. Because investors usually forget this basic rule, there is a lot of mis-selling of financial items which takes place. If a safe investment, such as a savings account, pays you 8% p.a. and a product that pays you even 10% p.a. is bound to be risker than keeping your money in savings account. If you do your homework on any investment product, then you would be able to evaluate the right kind of investment selection based on your risk profile.

A List Of Things One Must Ensure Before One Starts His Investment Journey: -

- Obtain written documents explaining the investment

- Read and understand such documents

- Verify the legitimacy of the investment

- Find out the costs and benefits associated with the investment

- Assess the risk-return profile of the investment

- Know the liquidity and safety aspects of the investment

- Ascertain if it is appropriate for your specific goals

- Compare these details with other investment opportunities available

- Examine if it fits in with other investments you are considering or you have already made

- Deal only through an authorized intermediary

- Seek all clarifications about the intermediary and the investment

- Explore the options available to you if something were to go wrong, and then, if satisfied, make the investment.

1.5 Types Of Investment Instruments

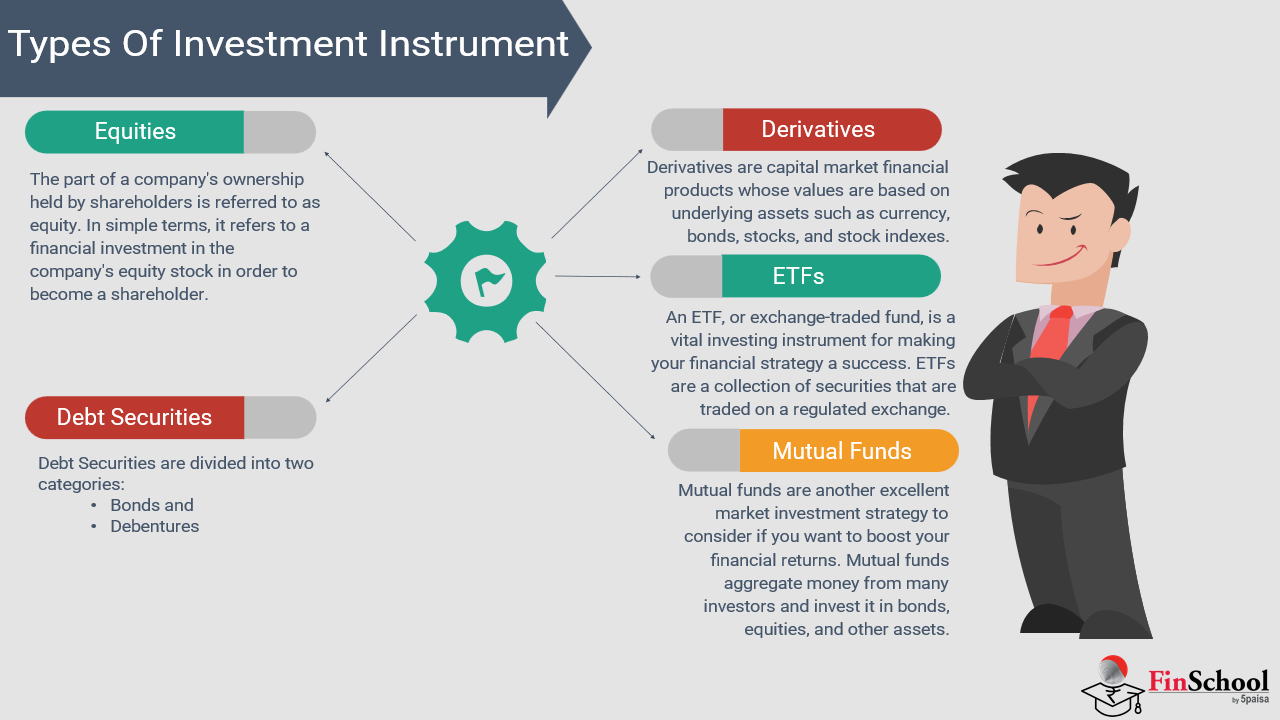

The Different Types of Investment Instruments are as Follows: -

Equities:

The part of a company's ownership held by shareholders is referred to as equity. In simple terms, it refers to a financial investment in the company's equity stock in order to become a shareholder.

The primary distinction between equity and debt holders is that equity holders do not get regular payments, but they can profit from capital gains by selling their holdings. In addition, equity holders receive ownership rights and become one of the company's owners. When a company goes bankrupt, equity holders can only share the remaining interest after debt holders have been paid. Companies also pay dividends to their shareholders on a regular basis as a result of earned earnings from their core business operations.

Debt Securities:

Debt Securities are divided into two categories: bonds and debentures.

Bonds -

Bonds are fixed-income instruments used to fund infrastructure development and other projects by the federal and state governments, municipalities, and even private firms.

Debentures -

Unlike bonds, debentures are unsecured investment choices with no collateral backing.

Derivatives:

Derivatives are capital market financial products whose values are based on underlying assets such as currency, bonds, stocks, and stock indexes.

Forwards, futures, options, and interest rate swaps are the four most prevalent types of derivative instruments. Let us learn about them:

Forwards -

It is an agreement between two parties in which the exchange occurs at a pre-decided price at the end of the contract. Forward contracts are unstructured contracts and operate in an unregulated market.

Future -

Futures are derivative financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and set price. Underlying assets include physical commodities or other financial instruments. Futures contracts detail the quantity of the underlying asset and are standardized to facilitate trading on a futures exchange.

Options -

The term option refers to a financial instrument that is based on the value of underlying securities such as stocks. An options contract offers the buyer the opportunity to buy or sell depending on the type of contract, the underlying asset they hold. Each contract will have a specific expiration date by which the holder must exercise their option. The stated price on an option is known as the strike price.

Interest Rate Swap -

An interest rate swap is a contract between two parties in which both parties agree to pay each other interest rates on their loans in different currencies, options, and swaps.

Exchange Traded Funds (ETFs)

An ETF, or exchange-traded fund, is a vital investing instrument for making your financial strategy a success. ETFs are a collection of securities that are traded on a regulated exchange. Stocks, bonds, commodities, currencies, or a mixture of them all are common investments in ETFs. When you buy an ETF as an investor, you're buying a basket of assets rather than a single item. Your stake in the total number of assets is proportionate to the number of shares you own in this regard.

Mutual Funds

Mutual funds are another excellent market investment strategy to consider if you want to boost your financial returns. Mutual funds aggregate money from many investors and invest it in bonds, equities, and other assets. Mutual funds are best suited if you have an expensive long-term goal or retirement plan in mind and want to diversify across financial instruments and buffer against anticipated market volatility.

1.6 Saving Or Investment - The Better Option

Saving and investing are vital concepts for establishing a strong financial foundation, but they are not interchangeable. While both can help you build a more secure financial future, people must understand the distinctions and know when to save and when to invest.

The level of risk taken is the most major difference between saving and investing. You will normally receive a lower return by saving, but you will be virtually risk-free. Investing, on the other hand, allows you to earn a bigger return while also exposing you to the danger of losing money.

Difference In Saving And Investing

The act of putting money aside for a future need or necessity is known as saving. When you decide to save money, you want the funds to be available as soon as possible, if not immediately. Savings, on the other hand, can be utilized for long-term purposes, such as ensuring that you have enough money at the correct time in the future. Savings are often deposited in a low-risk bank account.

Investing is similar to saving in that you are putting away money for the future, except that you are looking to achieve a higher return in exchange for taking on more risk. Stocks, bonds, mutual funds, and exchange-traded funds are common investments (ETFs).

The Better Option?

The majority of people frequently confuse the two terms. However, in the realm of finance, saving and investing are two different things. You are saving when you actively set aside a portion of your money in a safe and conveniently accessible account. Purchasing stocks, bonds, or any other financial commodity with the intention of profiting from capital appreciation, dividends, or regular distributions is referred to as investing. While both provide a good return on investment, the rate on investments is far larger than the rate on saves. Investments aren't just for the wealthy or those with a lot of money, it's for anyone who wants to better their financial situation and experience financial freedom. If you have heard the famous saying from warren buffet: -

If you do not find a way to make money work while you sleep, you will work until you die

-Warren Buffet

One might have read this quote a couple of times but have you wondered what it means or how are you going to make your money work for you once you are asleep? The answer is pretty simple one can do this by simply Investing their money.

The capital market encompasses all of these sorts of instruments. They are traded in a variety of ways because each one is unique and has distinguishing characteristics. As a result, it's critical to comprehend the many forms of investment instruments so that you can invest in them in accordance with your financial objectives.

1.7 Where Are The Investment Instruments Traded?

Investments instruments are traded on the Stock Exchanges. The stock exchange in India is a place for trading financial products such as stocks, bonds, and commodities.

It's a marketplace where buyers and sellers meet to exchange financial instruments at certain times during the business day, all while conforming to SEBI's well-defined criteria. Only corporations that are listed on a stock market, however, are permitted to trade on it.

Even if a stock is not listed on a reputable stock exchange, it can still be traded in an Over the Counter Market. However, such shares would not be highly valued in the stock market.

How Does It Work?

In India, most stock exchanges function independently because there are no "market makers" or "specialists" on staff. The whole stock market trading procedure in India is order-driven and takes place on an electronic limit order book. Orders are automatically matched with the help of the trading computer in this setup. Its purpose is to match market orders from investors with the most appropriate limit orders. The main advantage of an order-driven market is that it improves transaction transparency by publicly publishing all market orders. Brokers play a crucial part in the stock exchange market's trading structure, as all orders are placed through them. The advantages of direct market access, or DMA, are available to both institutional and retail investors. Investors can place orders directly into the trading system by using the trading terminals provided by stock exchange market brokers.

Prominent Stock Exchanges In India:

Bombay Stock Market (BSE) -

Located on Dalal Street in Mumbai, this stock exchange was founded in 1875. It is not only Asia's oldest stock exchange, but also the world's tenth largest stock exchange.

As of April, the market capitalization of the Bombay Stock Exchange was expected to be US$ 4.9 trillion, with roughly 6000 businesses openly listed on the exchange. The Sensex, which measures the performance of the BSE, reached an all-time high of 40312.07 in June of this year.

National Stock Exchange (NSE) -

The NSE was founded in Mumbai in 1992 and is considered India's first demutualized computerized stock exchange market. This stock exchange market was created with the goal of removing the Bombay Stock Exchange's monopolistic influence from the Indian stock market.

As of March 2016, the National Stock Exchange has a market capitalization of US$ 4.1 trillion, making it the world's 12th largest stock exchange. NIFTY 50 is the index of the National Stock Exchange of India, and it is widely used by investors throughout the world to assess the performance of the Indian capital market.

A stock exchange in India has a significant impact on the country's financial industry because it is such an important aspect of the Indian stock market. Their combined performances are a key determinant of economic growth.

Furthermore, all main types of stock exchanges are highly intertwined; if one big stock exchange collapses, it will have repercussions for all other major exchanges throughout the world.

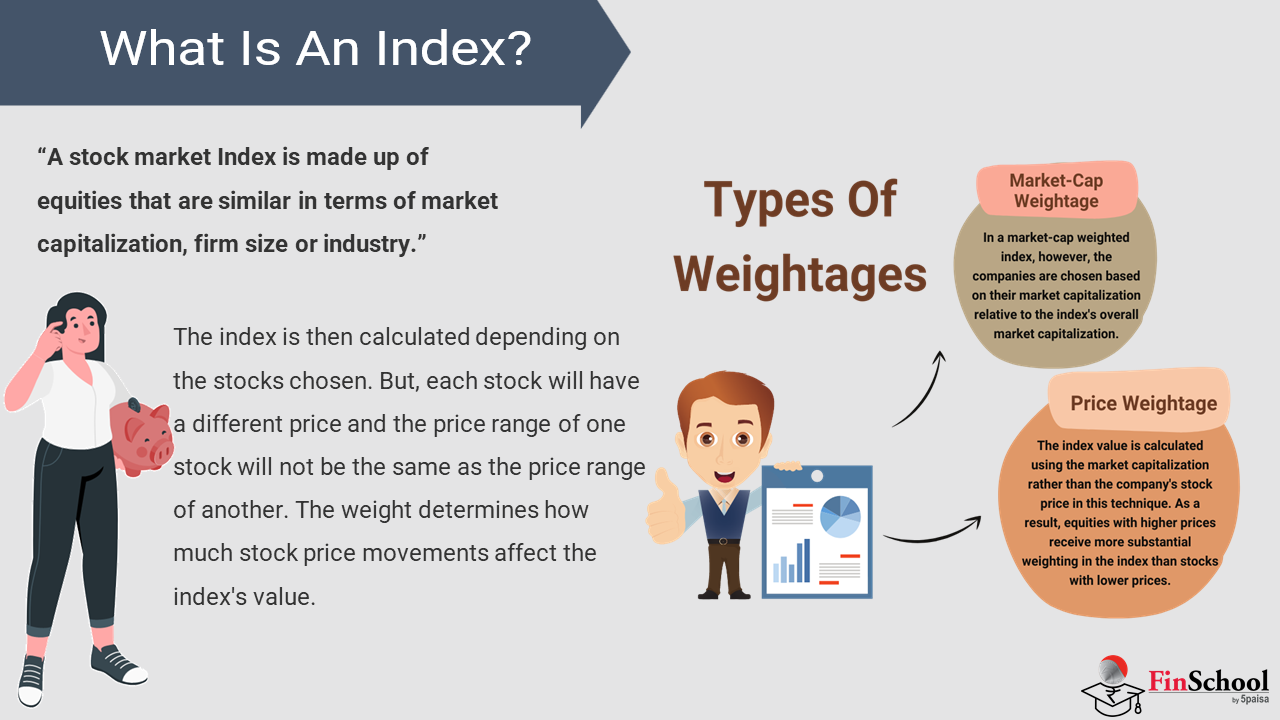

1.8 What Is An Index?

Meaning of a stock Market Index:

A stock market Index is made up of equities that are similar in terms of market capitalization, firm size or industry. The index is then calculated depending on the stocks chosen. But, each stock will have a different price and the price range of one stock will not be the same as the price range of another.

A stock market index, often known as a stock index, is a metric that displays all key movements in the Indian stock market. To create an index, a basket of the same equities is chosen from among the securities already gathered and listed on the stock exchange. For example, if a real estate index has to be created, stocks of all real estate companies listed have to be taken into account for calculating the Index. The selection criteria, on the other hand, are based on the industry, the size of the company, and its market capitalization.

This indicator is designed to reduce the blunder and to show the market's correct position. The value of the index is affected by changes in the price of the underlying assets. The stock index will climb if the price rises, and the index will fall if the stock prices fall. The two most prominent stock market indices in India are the Sensex and the Nifty. They are the benchmark indices, which are the most essential and serve as a point of reference for the whole Indian stock market. The value of the index cannot be determined by adding the prices of all the stocks. As a result, each company in the index is allocated a specific weighting depending on its current market price or market capitalization. The weight determines how much stock price movements affect the index's value. The most widely used stock market indices in India are the Nifty 50 and Sensex.

Types of Weightages:

- Market-Cap Weightage

The whole market value of a firm on the stock exchange is referred to as market capitalization. It is computed by multiplying the company's total number of outstanding stocks by the share price of each stock.

In a market-cap weighted index, however, the companies are chosen based on their market capitalization relative to the index's overall market capitalization.

- Price Weightage

The index value is calculated using the market capitalization rather than the company's stock price in this technique. As a result, equities with higher prices receive more substantial weighting in the index than stocks with lower prices.

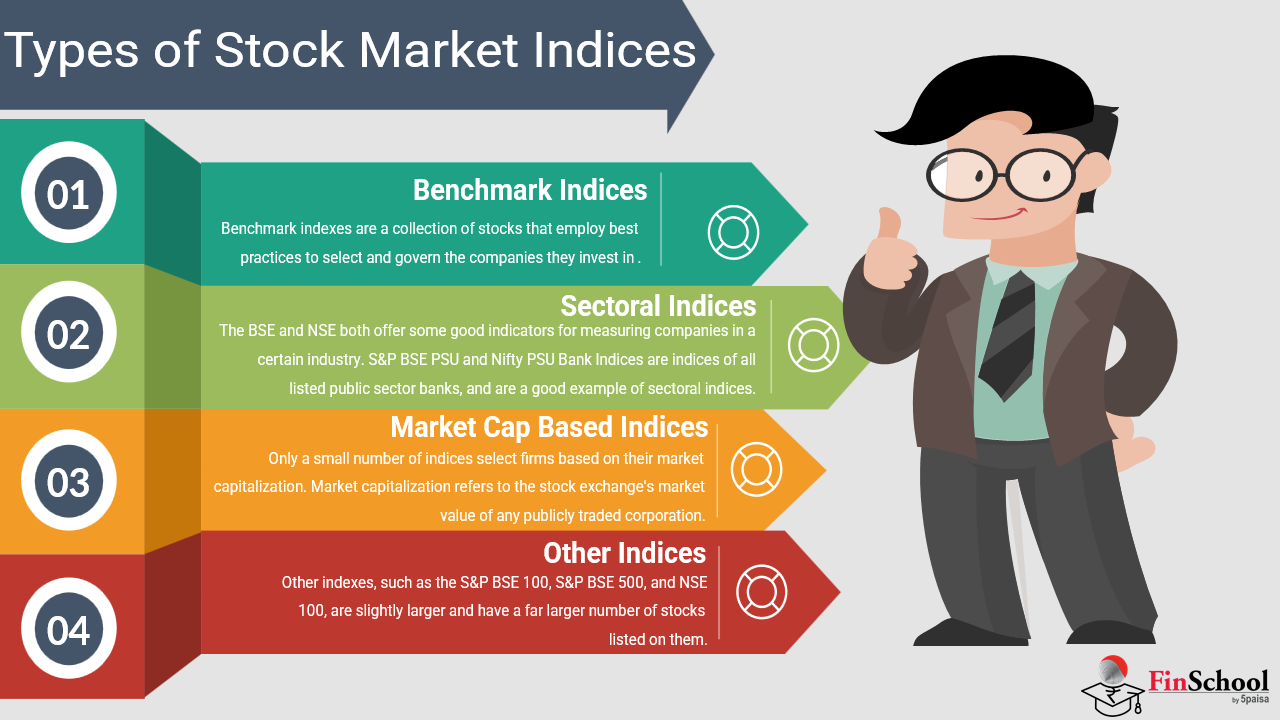

1.9 Types Of Stock Market Indices

Let Us Understand The Different Types Of Indices In Bit More Detail:

- Benchmark Indices -

The Nifty 50 index is made up of the top 50 best-performing stocks, and the BSE Sensex index, which is in turn made up of the top 30 best-performing companies. The Nifty 50 Index and the BSE Sensex Index are indicators of the National Stock Exchange and the Bombay Stock Exchange, respectively.

Benchmark indexes are a collection of stocks that employ best practices to select and govern the companies they invest in.

As a result, they are regarded as the most reliable source of information about how markets work in general.

- Sectoral Indices -

The BSE and NSE both offer some good indicators for measuring companies in a certain industry. S&P BSE PSU and Nifty PSU Bank Indices are indices of all listed public sector banks, and are a good example of sectoral indices. However, both exchanges are not required to have equivalent indexes for all sectors, but this is a common occurrence.

- Market-Cap Based Indices -

Only a small number of indices select firms based on their market capitalization. Market capitalization refers to the stock exchange's market value of any publicly traded corporation. Small-cap indices such as the S&P BSE and NSE small cap 50 are made up of companies with a lower market capitalization than the SEBI allows.

- Other Indices -

Other indexes, such as the S&P BSE 100, S&P BSE 500, and NSE 100, are slightly larger and have a far larger number of stocks listed on them.

What Is The Purpose Of Indices?

The primary idea behind indices is to make trading more convenient for investors. A stock market with no such categories is just an open marketplace where you may buy any of the stocks listed on the exchanges; you have no idea which stocks have a greater m-cap, which stocks have lesser value, or which are the "better" stocks. Like headless hunters, all investors will be on the prowl. The significance of stock market indices is appreciated at this point. They make trading easier by grouping them and increasing their visibility.

The stock market indices are an important aspect of the investment world. It is not just a plus, but also a requirement. Without it, the investment world would have been a shambles of investors looking for attractive stocks to buy. The relevance of stock market indices stems from the fact that they make investing simple.