- Study

- Slides

- Videos

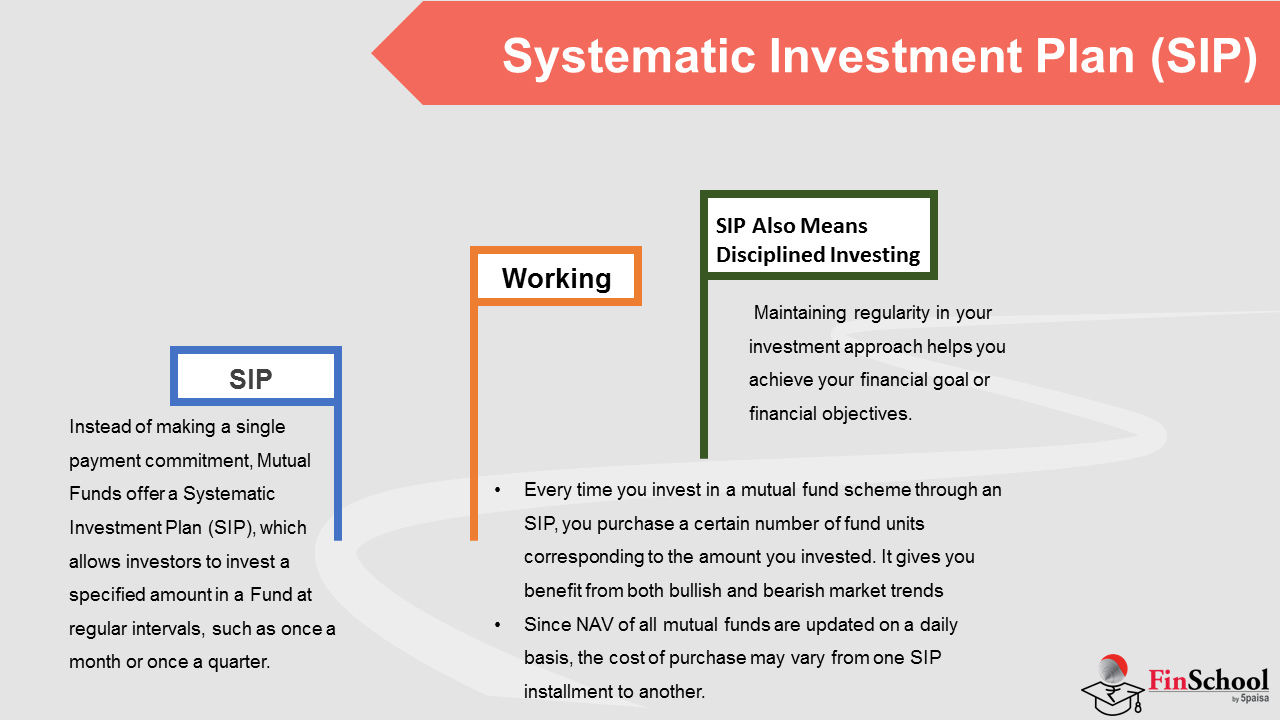

9.1 What Is a Systematic Investment Plan (SIP)?

Instead of making a single payment commitment, Mutual Funds offer a Systematic Investment Plan (SIP), which allows investors to invest a specified amount in a Fund at regular intervals, such as once a month or once a quarter. The monthly instalment amount, which is akin to a recurring deposit, could be as low as INR 500. It’s convenient because you can instruct your bank to subtract the sum.

SIPs are becoming increasingly popular among Indian mutual fund investors because they allow them to invest in a disciplined manner without having to worry about price volatility or market timing. They are considered passive investments since you continue to invest in them regardless of how well they perform.

How Does an SIP Work?

Every time you invest in a mutual fund scheme through an SIP, you purchase a certain number of fund units corresponding to the amount you invested. You don’t need to time the markets when investing through an SIP as you benefit from both bullish and bearish market trends.

When the markets are down, you purchase more fund units while you purchase fewer units when the markets are surging. Since NAV of all mutual funds are updated on a daily basis, the cost of purchase may vary from one SIP instalment to another. Over time, the cost of purchase averages out and turns out to be on the lower side. This is known as rupee cost averaging. This benefit is not available when you invest a lump sum.

Additionally SIP helps you creating wealth . For example, let’s assume that the NAV for a mutual fund you invested is Rs.100. If you invest Rs 10,000 in that mutual fund, you will be allotted 100 units of the scheme. As the NAV of the mutual fund increases, your investments will also grow accordingly. So, if the next year, the NAV of this fund becomes Rs 130, then the 100 units that you had bought for Rs 10000, would be worth Rs 13000 after the increase. This is the way your investment grows, helping you to create wealth over the long term.

SIP Also Means Disciplined Investing

Investing through SIPs brings a discipline in your investment approach. Ace investors often recommend that your day-to-day financial activities should be fashioned around a simple formula of Earning-Savings = Expenses.

Let’s suppose you earn Rs X every month, and if you are unable to control your spending, within a given budget, it might happen that at the end of the month you are left with nothing to save.

But, if you invest in SIP, you will be compelled to follow a disciplined investment regime. If you are aware of what your expenses are, you will make a habit of spending within the budget. Within that, first you will save and then spend. If you fashion your financial activities around this, i.e. first save and then spend, you will never face any financial hardship as you are following a disciplined investment approach. Maintaining regularity in your investment approach helps you achieve your financial goal or financial objectives.

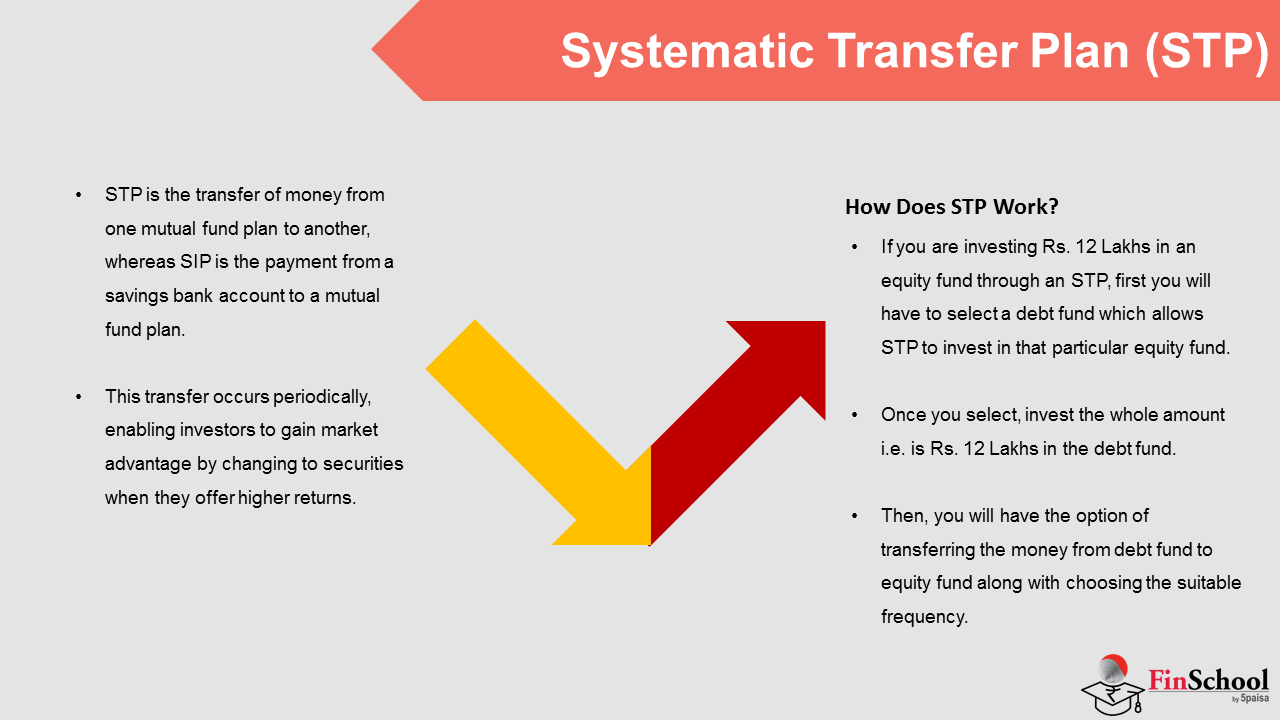

9.2 What Is Systematic Transfer Plan (STP)?

STP is the transfer of money from one mutual fund plan to another, whereas SIP is the payment from a savings bank account to a mutual fund plan. STP is a smart approach for reducing risks and balancing rewards by staggering your investments over a set period of time.

In other words, A systematic transfer plan allows investors to shift their financial resources from one scheme to the other instantaneously and without any hassles. This transfer occurs periodically, enabling investors to gain market advantage by changing to securities when they offer higher returns. It safeguards the interests of an investor during market fluctuations, to minimize the damages incurred.

How Does STP Work?

If you are investing Rs. 12 Lakhs in an equity fund through an STP, first you will have to select a debt fund which allows STP to invest in that particular equity fund. Once you select, invest the whole amount i.e. is Rs. 12 Lakhs in the debt fund. Then, you will have the option of transferring the money from debt fund to equity fund along with choosing the suitable frequency.

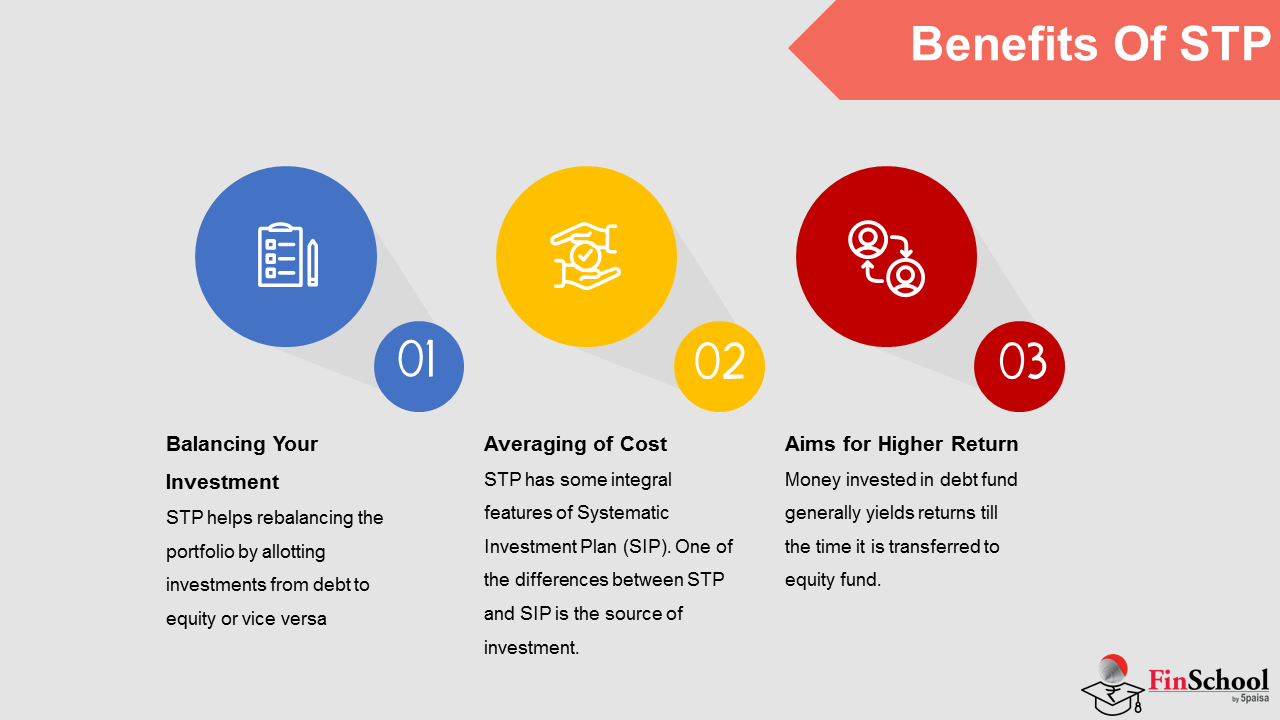

Benefits of STP

Balancing your investment

STP helps rebalancing the portfolio by allotting investments from debt to equity or vice versa

Averaging of Cost

STP has some integral features of Systematic Investment Plan (SIP). One of the differences between STP and SIP is the source of investment. In case of the former, money is transferred usually from a debt fund and in case of latter; it is the investor’s bank account. Since it is similar to SIP, STP also helps in Rupee Cost Averaging

Aims for Higher Return

Money invested in debt fund generally yields returns till the time it is transferred to equity fund. The returns in debt funds are usually higher than savings bank account and aims to assure relatively better performance.

Types of STPs

There are different types of STPs one could follow. For instance, under fixed STP, investors transfer a fixed sum from one investment fund and transfer it to another fund. In capital appreciation STP, the investors take out the profit that they have made on one investment and invest in another investment fund. In Flexi STP, investors could choose to transfer a variable amount. The fixed amount would be the minimum amount and the variable amount depends on the volatility of the market.

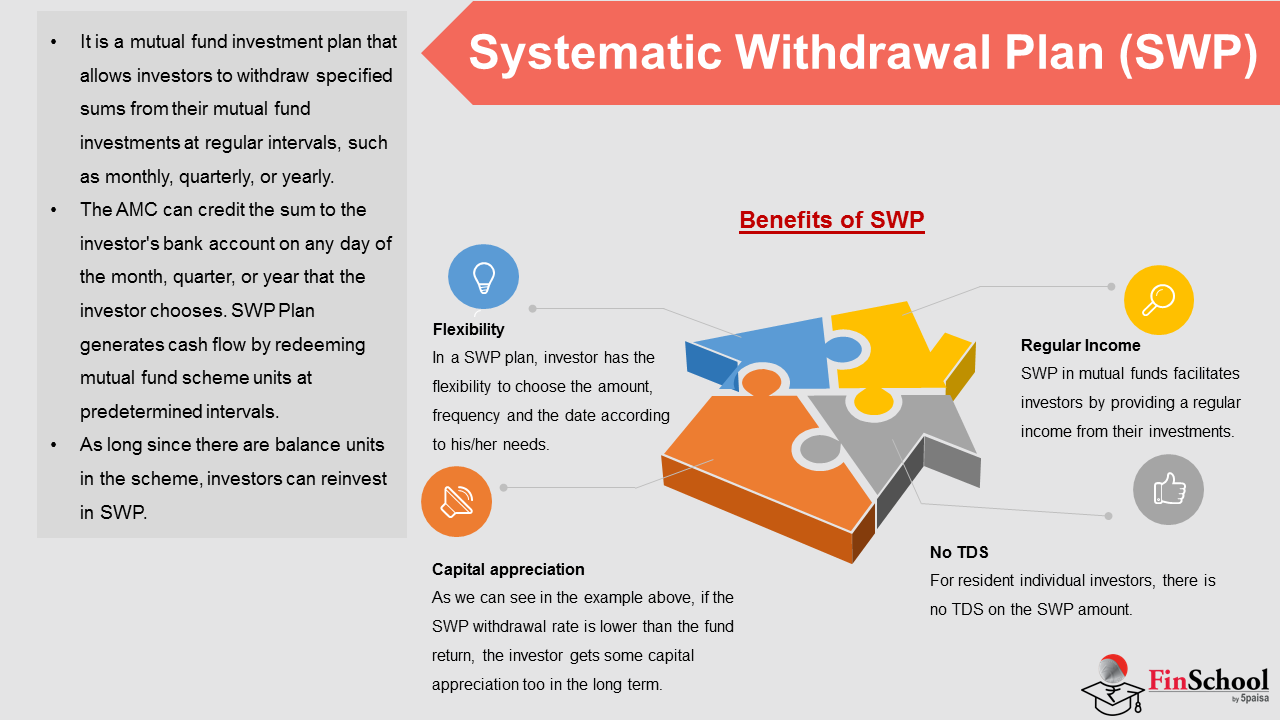

9.3 What Is Systematic Withdrawal Plan (SWP)?

It is a mutual fund investment plan that allows investors to withdraw specified sums from their mutual fund investments at regular intervals, such as monthly, quarterly, or yearly.

The AMC can credit the sum to the investor’s bank account on any day of the month, quarter, or year that the investor chooses. SWP Plan generates cash flow by redeeming mutual fund scheme units at predetermined intervals. As long since there are balance units in the scheme, investors can reinvest in SWP.

Example – Investor invests lump sum Rs 10.00 lakhs in a mutual fund scheme. The purchase NAV is Rs 20; therefore, 50,000 units are allotted. Let us assume investor started a monthly SWP of Rs 6,000 after one year from the investment date, just to avoid exit loads.

In the 1st month of SWP, let us assume the scheme NAV was Rs 22. In order to generate Rs 6,000, the AMC redeems 272.728 units (Rs 6,000 / 22 NAV), therefore, the balance units will now be 49,727.272 (50,000 minus 272.728). In the 2nd month, assuming NAV was 22.50, the AMC redeems 266.667 units (Rs 6,000 / 22.50 NAV), therefore, the unit balance reduces to 49,460.605 (49,727.272 minus 266.667). In the 3rd month, assuming the NAV was 23.00, the AMC redeems 260.8696 units (Rs 6,000 / 23.00 NAV) and now the unit balance reduces to 49,199.7354. This process continues every month till the end of the SWP period chosen by the investor.

As seen in the above example, unit balance reduces over time in SWP plan, but if the scheme NAV appreciates at a percentage higher than the withdrawal rate, the investment value appreciates. To take the above example, after the 3rd SWP payment, the fund value stands at Rs 11,31,593.91 (49,199.7354 units x Rs 23 NAV) against the investment value of Rs 10.00 Lakhs. This is an appreciation of Rs 131,593.91. However, if the scheme NAV falls instead of rising, then effect on your investment value will be opposite. This is because withdrawals in scenario where NAV is falling will require more number of units to be redeemed.

Benefits of SWP

Flexibility

In a SWP plan, investor has the flexibility to choose the amount, frequency and the date according to his/her needs. Also, the investor can stop the SWP at any point in time / or can add further investments or even withdraw amount over and above the fixed SWP withdrawals.

Regular Income

SWP in mutual funds facilitates investors by providing a regular income from their investments. Therefore, this becomes highly convenient and useful for those who need regular cash flow for meeting regular expenses.

Capital appreciation

As we can see in the example above, if the SWP withdrawal rate is lower than the fund return, the investor gets some capital appreciation too in the long term.

No TDS

For resident individual investors, there is no TDS on the SWP amount.

9.4 Mutual Fund Plans

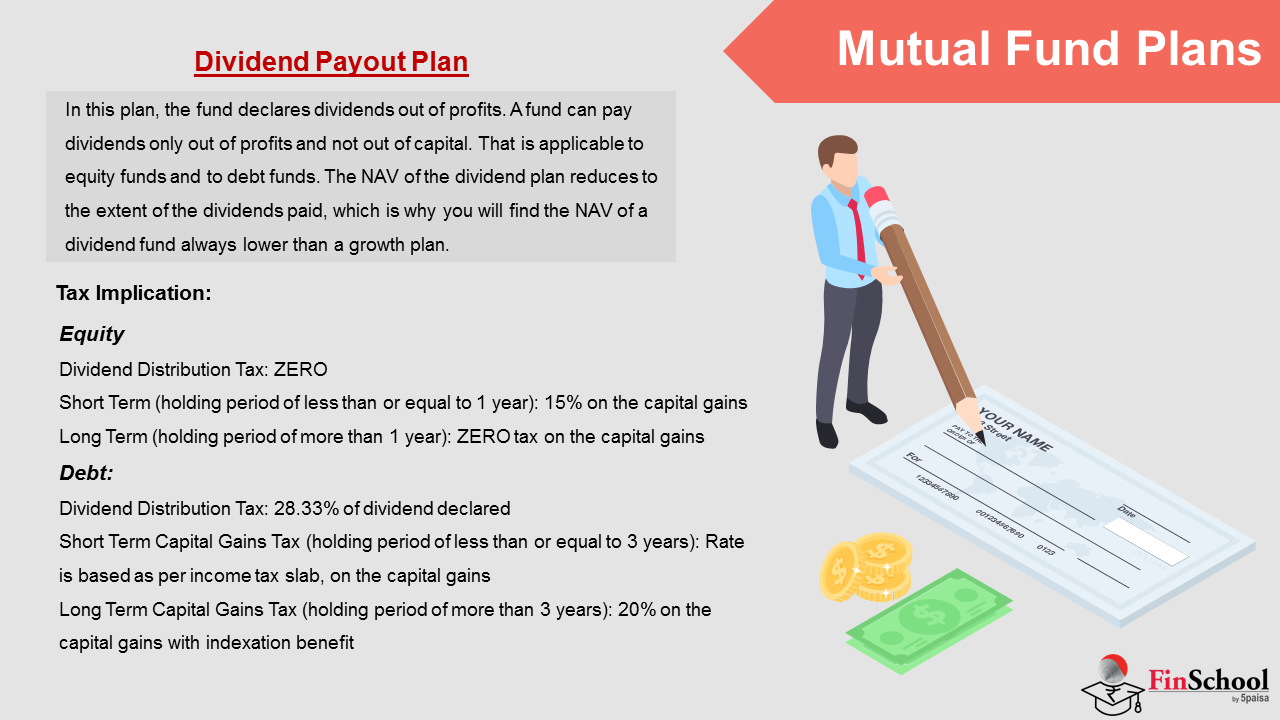

Dividend Payout Plan

In this plan, the fund declares dividends out of profits. A fund can pay dividends only out of profits and not out of capital. That is applicable to equity funds and to debt funds. The NAV of the dividend plan reduces to the extent of the dividends paid, which is why you will find the NAV of a dividend fund always lower than a growth plan.

These dividends are paid out directly to the owner in a dividend payout situation. Dividends are usually paid straight into a cash account, sent electronically into a bank account, or mailed out by cheque if the shareholder prefers this option. In most circumstances, shareholders do not pay any fees if their dividends are paid in cash, as they do with the dividend reinvestment option.

The tax consequences of dividends are unaffected by whether they are reinvested or paid out. Dividend distributions are regarded the same way in both situations from a tax standpoint. This option is suitable for investors who need regular income from their mutual funds. While you may receive income in the form of dividends regularly, you lose out on the opportunity to reinvest and grow your investments.

Tax Implication:

Equity

Dividend Distribution Tax: ZERO

Short Term (holding period of less than or equal to 1 year): 15% on the capital gains

Long Term (holding period of more than 1 year): ZERO tax on the capital gains

Debt:

Dividend Distribution Tax: 28.33% of dividend declared

Short Term Capital Gains Tax (holding period of less than or equal to 3 years): Rate is based as per income tax slab, on the capital gains

Long Term Capital Gains Tax (holding period of more than 3 years): 20% on the capital gains with indexation benefit

Dividend Reinvestment

A dividend reinvestment plan (DRIP or DRP) is a firm’s plan that allows shareholders to automatically reinvest their cash dividends in more shares of the company on the dividend payment date. Dividend reinvestment arrangements are usually free of commissions and discount on the current value.

Dividends are utilised to buy more fund units when you choose the dividend reinvestment option. In other terms, rather than paying out dividends, the money is utilised to buy more fund units on the investor’s behalf. The new units are credited to the unit holder’s wallet.

The number of items possessed by the investor grows over time as a result of the dividend reinvestment choice. As a result, the investment’s value grows rapidly than it would if the dividends were not invested.

Since it accounts for the amount announced, the dividend reinvestment option has a lower NAV. However, by the end of their investment, the unitholder will have a larger number of units. As per the new income tax rules, all dividends received from Mutual Fund schemes after April 1, 2020, will be taxable in the hands of the investors as per their tax slab. And the income tax rules do not give you any relaxation if you reinvest the dividends in the same mutual fund scheme. So, even as you are not receiving the dividend in your bank account, you need to pay a tax on the dividends because the income tax department considers dividends as your income.

Thus, if you fall in the 30% tax bracket, you will pay 30% as tax on the dividends declared in the Reinvestment Plan in a financial year. So, this will further reduce your returns from Mutual Funds

Tax Implications of Dividend Reinvestment Option

Equity:

Dividend Distribution Tax: ZERO

Short Term (holding period of less than or equal to 1 year): 15% on the capital gains

Long Term (holding period of more than 1 year): ZERO tax on the capital gains

Debt:

Dividend Distribution Tax: 28.33% of dividend declared

Short Term Capital Gains Tax (holding period of less than or equal to 3 years): Rate is based as per income tax slab, on the capital gains

Long Term Capital Gains Tax (holding period of more than 3 years): 20% on the capital gains with indexation benefit

Growth Option

In growth option, profits made by the scheme are re-invested in the scheme instead of being paid out to investors. Since profits are re-invested in the scheme, you may earn profits on profit and thereby benefit from compounding.

So, whenever the scheme makes a profit, its NAV rises automatically. Conversely, when the scheme suffers a loss, the NAV falls. The only way to get back profits is to sell units of the scheme. Suppose you buy 100 units of an equity fund at a NAV of Rs 40. Under the growth option, the NAV of the scheme rises to Rs 50 in one year. You sell the units and receive a sum of Rs 5,000. Hence, your profits from the investment are Rs 1,000 (Rs 5,000-Rs 4,000).

This option is best suited for investors who don’t need regular income in the form of dividends.

Tax Implications of Growth Option

Equity: Only Capital Gains Tax

Short Term (holding period of less than or equal to 1 year): 15% on the capital gains

Long Term (holding period of more than 1 year): ZERO tax on the capital gains

Debt: Only Capital Gains Tax

Short Term (holding period of less than or equal to 3 years): Rate is based as per income tax slab, on the capital gains

Long Term (holding period of more than 3 years): 20% on the capital gains with indexation benefit

Key Difference Between Dividend Vs Growth Plan

The difference between a growth plan and dividend plan can be best understood with the help of an example.

- Assume that you have Rs.1000 invested respectively with 100 units each in the growth and dividend option of a fund.

- The NAVs of the growth and the dividend options are at Rs.20/- each.

- Say that the fund declares a 20% dividend. On a face value of Rs.10/- per unit, the dividend payout will be Rs.2/- per unit held.

- Your investment in the dividend option will yield a dividend of Rs. 200 (Rs.2/- x 100 units). The NAV of the dividend option will now fall to Rs.18/- (NAV Rs.20/- -Rs. 2/- of dividend).

- If you now redeem all your units in both the options, the investment in the growth option with yield Rs.2,000 (NAV Rs.20/- x 100 units) while that in the dividend option will give you Rs.1,800/- (NAV Rs.18/- x 100 units).

- However, since you have already received a dividend of Rs.200/-, the total yield from both these investments are exactly the same (Rs.2,000/- in Growth Option & Rs.1,800/- through redemption of units + Rs.200/- in dividends in Dividend Option).

Thus- The choice between these 2 options should primarily be driven by your cash flow requirements. If you do not have any periodic liquidity needs, you may choose the growth option. The returns in the growth option will be reflected in the movement of the scheme’s NAV. On the contrary, if you need regular cash flows from your investments, then choose the dividend option. However, please note that dividend payment is not assured and there may not be any dividends if the fund fails to generate any surpluses.

Difference Between Growth Vs Dividend Re-investment

At a glance, both plans look very similar. However, if you examine closely, you would see that while profit is directly reinvested in growth option funds, it is re-invested as a dividend in dividend reinvested funds.

This reinvestment of dividend attracts a dividend distribution tax i.e. DDT of 28.84% that has to be paid on the dividends declared.

Thus, the dividend distribution tax is one of the factors that make it noteworthy to understand which option is better in terms of tax saving for you.