- Study

- Slides

- Videos

8.1 Capital Gain Taxation

According to the Income Tax department, profit arising from the sale or exchange of a capital asset made in a previous financial year is taxable as capital gains. The important things to consider for a capital gain are the existence of capital assets, transfer of such assets and profit and gains that arise from such profits.

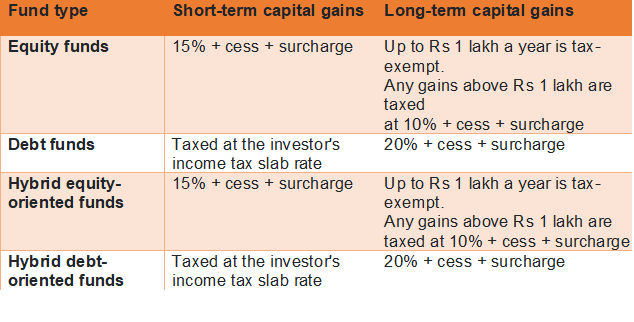

For the purpose of taxation of capital gains, mutual fund schemes are divided into two categories. Equity-oriented schemes is one category and rest of the schemes constitute the second category. For equity-oriented schemes, your investment becomes long-term if you redeem them after one year whereas investments in the rest of the schemes become long-term after three years.

What is considered as equity oriented mutual funds?

Any mutual fund scheme which keeps minimum of 65% of their corpus invested in the Indian companies which are listed in India fall under equity oriented schemes. Likewise, any fund which invests minimum 90% of its corpus in an ETF which in turn invests minimum of 90% of its corpus in these companies is also treated like equity oriented schemes. By this definition all aggressive hybrid funds which maintain their minimum 65% investment in such companies are treated as equity oriented schemes. All other schemes like conservative hybrid schemes, debts funds, gold ETF, gold funds and international funds fall in the second category.

Understanding Long term & Short Term Capital Gains Tax

Long term capital gains are the gains when you hold an asset for a long period of time and then sell it. The profit here earned is termed as LTCG. Gains from equity mutual funds held for more than 12 months attract long-term capital gains tax at 10% if the total long term capital gains amount from equity oriented mutual funds/ equity shares exceed Rs 1,00,000 in a year. Returns below that threshold are tax-free. Gains from debt funds, on the other hand, are taxed at 20 per cent after indexation benefit, if held for over 36 months. Indexation refers to gains adjusted for inflation. Without indexation, the tax on debt funds would be higher.

Short term capital gains are just opposite of long-term gains. Here, short term capital gain is charged- if you have bought any stock or equity and sell it within a year i.e the holding period is less than a year. The Tax rate is 15%. For e.g., if you have a gain of Rs.1 lakh, then you have to pay a tax of Rs.15000 on this short-term capital gain. For debt funds, a holding period of fewer than 36 months is considered a short-term investment. Short-term capital gains on debt funds are taxed according to your individual income slab.

Set Off of Losses of Capital Gains on Mutual Funds

All short term capital gains and long term capital gains are aggregated separately. Short term loss can be adjusted against long term gains but long term loss cannot be adjusted against short term gains. Loss under the head capital gains cannot be adjusted against income under any other head. Any capital loss not adjusted during the current year is allowed to be carried forward for next 8 years for set off in subsequent years.

How Dividends From Mutual Fund are Taxed

Dividends are taxed like your regular income under the head income from other sources. The mutual fund house deduct tax at 10% on dividends, in case the aggregate dividends likely to exceed five thousand in a year for all the schemes of the same fund house. If you have borrowed to invest in mutual funds, you can claim interest up to 20% of the aggregate dividend amount against such income.

8.2 Indexation And Its Benefits

Indexation is a technique to adjust tax payments by employing a price index which adjusts for inflation.

Or, in other words, indexation is the process that takes into account inflation from the time you bought the asset to the time you sell it. The way it works is that it allows you to inflate the purchase price of the asset to take into account the impact of inflation. The end result is that you get the benefit of lowering your tax liability.

Inflation erodes the value of the asset over time. Take Rs 5,000. Over 5 years, assuming an annual rate of inflation of 5%, its actual value would drop to Rs 3,868. This impact of inflation over the value of an asset cannot be ignored. Hence it must be taken into account when computing tax on the difference between the buy and sell cost.

It is for this reason that the government uses the Cost Inflation Index, or CII. This is an inflation index tool used to measure the rate of inflation in the economy. The value of the index is determined by the central government and is increased every year to reflect inflation.

Indexation= (Index for the year of sale/ Index in the acquisition) * cost

Ms Ridhi had invested Rs. 1 lakh during the year 2015-16 in a debt fund and redeemed the investment for Rs. 1.35 lakh during the year 2020-21. The absolute returns generated by Ms. Ridhi from this investment is Rs. 35,000. However, considering the holding period of around five years for an investment in a debt fund, he is eligible for indexation benefit.

The indexed cost of investment comes out to be Rs. 1.19 lakh (Rs. 1 lakh X 301/ 254). As such, the taxable LTCG on this investment by Ms. Ridhi will be calculated as Rs. 1.35 lakh minus Rs. 1.19 lakh, i.e., Rs. 16,000. While the tax rate on LTCG on debt funds is 20%, the effective tax for Ms. Ridhi on this investment comes to Rs. 3,200, resulting in an effective tax rate of 9.14% of the absolute returns generated. This is how indexation helps the investors to lower the effective tax incidence on the returns generated from non-equity funds, i.e., debt funds, etc. and consequently increasing the post-tax returns.

Note- The value 301 and 254 are nothing by Cost inflation index published by the government. 301 was the cost inflation of the year 2020-201 and 254 was the CII for the year 2015-2016.