- Study

- Slides

- Videos

11.1 What are Gaps?

A gap is an area discontinuity in a security’s chart where its price either rises or falls from the previous day’s close with no trading occurring in between. Gaps are common when news causes market fundamentals to change during hours when markets are typically closed, for instance an earnings call after-hours.

An upward gap occurs when the lowest price for one day is higher than the highest price of the preceding day. A downward gap means that the highest price for one day is lower than the lowest price of the preceding day.

Therefore, a gap is nothing more than the result of the price of the stock being either bid up, or bid down, prior to the market opening for trading that particular day. Generally it happens because of news. For instance, a company may have released a report causing traders to believe the stock is suddenly worth more or less than it was the day before. If the earnings for the previous quarter had significantly increased and were much better than expected, the stock price may Gap up. And conversely, if the company reported disappointing earnings, this may cause the price to Gap down at the opening of trading. As we learned in chapter one, this is directly related to the market factoring in, or discounting everything. There are many other factors that can cause a gap, but its generally news related.

There are different types of gaps that appear at different stages of the trend. Being able to distinguish among them can provide useful and profitable market insights.Three types of gaps have forecasting value — breakaway,runaway and exhaustion gaps.

11.2 Why Are Gaps Filled?

You have obviously seen that there are Gap ups, and Gap downs. But gaps are normally filled. Why?

Let me give you a little more understanding of gaps, and at the same time answer the question of why they are filled. To do this, we need to understand who sets the opening price that causes a Gap Up or Gap Down.

Remember, whether you are trading, or buying as an investor for the long term, gap trading is risky business, and the specialists who mark stocks up or down prior to the open of the market have a vested interest in doing so.

A market maker (specialist) is the professional on the trading floor of the exchange who makes his/her living buying from, and selling stocks to the public. A market maker is also the professional on the trading floor whose job is to provide liquidity to the market. This means that the market maker is obligated to buy and sell the stocks that he/she provides a market for.

For instance: One Market Maker may provide a market for only one stock. And that Market Maker is obligated to buy and sell that stock to and from the public in order to provide liquidity, a balanced market, and this allows the public to always be able to buy or sell that stock, at some price.

A Market Maker (Specialist) is also responsible for managing large movements by trading out of their own inventory. If there is a large shift in demand on the buy or sell side, the specialist will step in and sell out of their inventory to meet the demand until the trading gap has been narrowed. This adds liquidity, and keeps the market flowing smoothly.

Now, if you were a Market Maker, providing liquidity to the market, where would you open a stock for trading with poor news, knowing you would be receiving sell “market on open” orders? (Sell orders for that stock at the market price at the open of the market for trading that day) You would open them as low as possible, (where you felt the stock was well supported and would have buying interest). In other words, you might be the one buying these shares and you wan you want to buy at a price level that you feel you can sell at later, profitably.

This is known as ‘buying weakness.’ Conversely, with strong news on a stock, knowing you would have ‘Buy Orders’ at the open, and you, as the market maker, would be selling at the open, where would you open the stock for trading?

As a market maker, you’d open that stock at as high a level as possible (to enable you to sell stock to buyers at would-be resistance levels). This is referred to as ‘selling strength.’ This is why gaps have a greater propensity to close immediately after the open. Thus, many gaps do not show on the charts because they are closed within the first few minutes of trading.

11.3 Types of GAP

Breakaway Gap

The breakaway gap usually occurs upon completion of an important price pattern and signals a significant market move. It occurs when the price gaps above a support or resistance area, like those established during a trading range. When the price breaks out of a well-established trading range via a gap, that is a breakaway gap. For instance, a breakout above the neckline of an inverted head and shoulders bottom or after a double bottom pattern has formed would be a time a breakaway gap might occur.

Breakaway gaps usually occur on heavy volume. More often than not, breakaway gaps are not filled. Prices may return to the upper end of the gap (in case of a bullish breakout) and may even close the portion of the gap, but some portion of the gap is often left unfilled. As a rule, the heavier the volume after the gap appears, the less likely it will be filled.

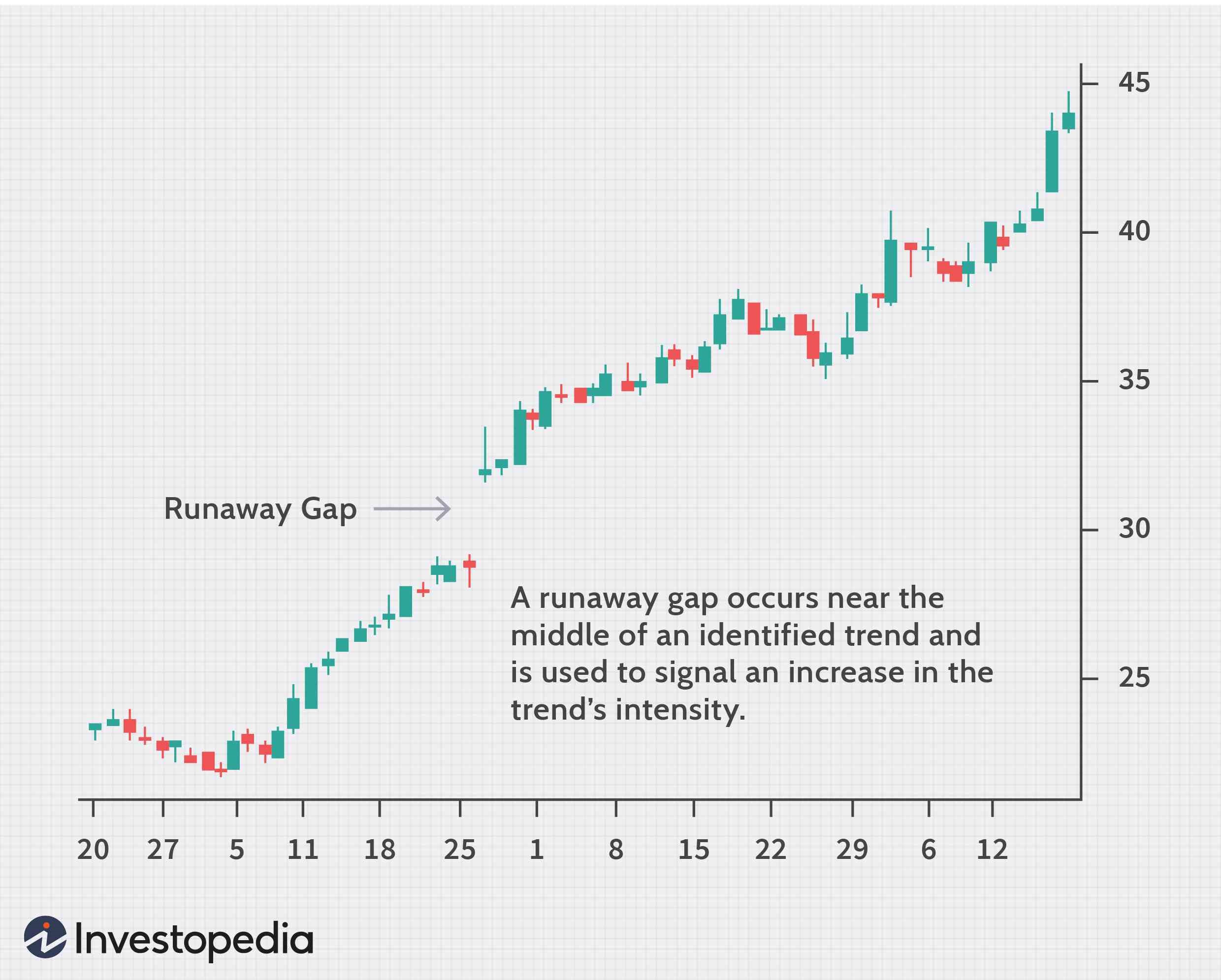

Runaway Gap

The runaway gap usually occurs after the trend is well underway. It often appears about halfway through the move (which is why it is also called a measuring gap since it gives some indication of how much of the move is left.)

This type of gap reveals a situation where the market is moving effortlessly on moderate volumes. During uptrends, the breakaway and runaway gaps usually provide support below the market on subsequent market dips; during downtrends, these two gaps act as resistance over the market on bounces

Exhaustion Gap

The exhaustion gap occurs right at the end of the market move and represents a last gasp in the trend. Sometimes an exhaustion gap is followed within a few days by a breakaway gap in the other direction, leaving several days of price action isolated by two gaps.

Exhaustion gaps are different than the other gaps, mainly because of the reason for the gap. At the top, the reason is unrealistic, and based on false hopes and dreams. At the bottom it is because those same hopes and dreams are vanishing, very rapidly.

Each type of gap has certain consequences for traders. For example, reversal or breakaway gaps are typically accompanied by a sharp rise in trading volume, while common and runaway gaps are not. Additionally, most gaps occur due to news, or an event such as earnings or an analyst’s upgrade/downgrade.

11.4 What should you do with a GAP?

For instance: Let’s say you have been watching XYZ stock, you have done your proper research in studying the charts, past history, price movements, etc. You now feel this stock is a buy at this level. But you notice that the stock is gapping up when the market opens.

Number One: You should never simply place a ‘Market Order’ to buy a stock, and then leave for work knowing that it will be bought for you at the market price when the market opens. This could get the stock purchased for you at the high of the day, and then the price retreats, closing the Gap, and never advance to the price you actually paid. As you can imagine, there’s nothing quite as discouraging than starting a trade off with a loss.

If you cannot watch the market prior to placing your order, then at a minimum, place a “Limit Order” to buy. Meaning, as an example: you would specify on your order to buy at 25 or better. This way if the stock gapped up, opening at 26, your order would not be filled until the stock price came back down to your entry price or lower. Using the previous day closing price would be a good point – that way if the gap was closed that day you would be buying at the bottom of the gap. This would increase your chances of being profitable in the event the gap closed and then the price began an advance. A Limit Order can also be used to sell, in the event you were ready to sell a stock, and it was gapping up, or down.