- Study

- Slides

- Videos

11.1 Introduction

The asset-based valuation approach estimates the value of common stock by calculating the difference between the value of a company’s total assets and its outstanding liabilities. In other words, the asset-based valuation approach estimates the value of common equity by calculating a company’s net asset value.

The asset-based valuation approach implicitly assumes that the company is liquidated, sells all its assets, and then pays off all its liabilities. The residual value after paying off all liabilities is the value to the shareholders.

The difference between total assets and total liabilities on a company’s balance sheet represents shareholders’ equity, or the book value of equity. But the values of some assets on the balance sheet are based on historical cost (the cost when they were purchased), and the actual market value of these assets may be very different. For instance, the value of land on a company’s balance sheet, typically carried at historical cost, may be quite different from its current market value.

As a result, estimating the value of the equity of a company using asset values taken directly from the balance sheet may provide a misleading estimate. To improve the accuracy of the value estimate, current market values can be estimated instead. Also, some assets may not be included on the balance sheet because of financial reporting rules.

For instance, some internally developed intangible assets, such as a brand or reputation, are not listed in the financial reports. It is important that analysts using asset-based valuation estimate reasonable values for all of a company’s assets, which can be very challenging to do.

11.2 Why Would You Do Asset Based Valuation?

Liquidation: If you are liquidating a business by selling its assets piece meal, rather than as a composite business, you would like to estimate what you will get from each asset or asset class individually.

Accounting mission: As international accounting standards have turned to “fair value” accounting, accountants have been called upon to redo balance sheet to reflect the assets at their fair rather than book value.

Sum of the parts: If a business is made up of individual divisions or assets, you may want to value these parts individually for one of two groups:

-

Potential acquirers may want to do this, as a precursor to restructuring the business.

-

Investors may be interested because a business that is selling for less than the sum of its parts may be “cheap

11.3 Example of Asset Based valuation Model

The company we will look at is a coffee shop called Costa’s Coffee Shop. Unfortunately, the coffee shop has fallen on hard times. Sam, the business owner, is looking to sell the business as the company is no longer profitable and the future earnings potential of the business is very questionable. Given the circumstances, including the fact that the business is very unlikely to be profitable in the near future, the value of the business will be calculated using the asset approach method.

In this scenario, an interested business buyer named Mr. Naman finds a listing of the coffee shop business for sale. Naman sees that the business is unprofitable and appears to be on a downward trajectory, with little chance of the coffee shop returning to profitability for quite some time. Naman, therefore, decides to value the business according to the net assets valuation of the business. Naman decides to request the most recent balance sheet in order to calculate the value of the net assets.

Below are the steps that would need to be followed in order to calculate the value of the Sam’s Coffee Shop business:

Step 1- Listing of all assets and liabilities of the business

Step 2-Calculation of the fair market value of all of the assets and liabilities of the business

Step 3- Subtraction of the fair market value of the liabilities from the fair market value of the assets in order to arrive at the equity value, also referred to as net assets value, of the business.

Remember, the equation for this is Assets – Liabilities = Equity

Step 1

Detailed Calculation:

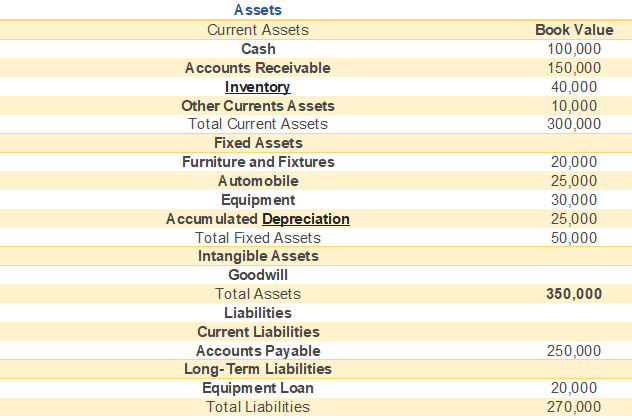

Sam, the business owner, provides Naman, the potential business buyer, with a list of the value of the assets and liabilities according to the official balance sheet as prepared by Sam’s accountant. The table can be found below:

Step 2

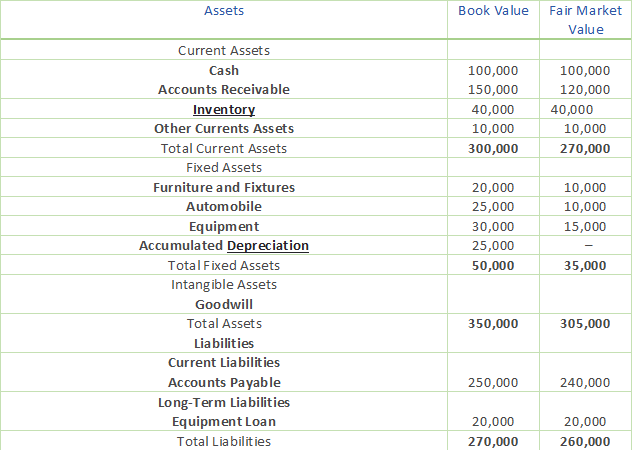

Naman, the business buyer, enlists his accountant to help him figure out the fair market value, which is the price the assets would sell for on the open market and the amounts due to other parties on the outstanding liabilities.

The updated table can be found below:

STEP 3

Naman and his accountant subtract the fair market value of the liabilities from the fair market value of the assets in order to arrive at the equity value, also referred to as net assets value, of the business. It appears that the adjusted net assets value of the coffee shop business is lower than the latest book value of the business.

Net Assets= 305000-260000

= Rs.45000

The same calculation when we do on book value- Total asset-total liabilities

= 350000-270000= Rs.80000

With the fair market net assets value of the coffee shop business in hand, Naman then works with business broker to negotiate a purchase of Costa’s Coffee Shop. He has the knowledge of what he could receive for the net assets on the open market, so his goal is to find a price below that value as he negotiates with Sam to purchase the business.

11.4 Advantages of Asset Based Approach

-

It can be used to determine the base level of value that a business could be worth upon liquidation. However, this value is often changed to adjust the assets and liabilities to their respective fair market value.

-

The calculation is straightforward. The conclusion to value is merely Assets minus Liabilities. The process can be more complicated when adjusting certain assets or liabilities, but it’s still simple arithmetic!

-

It can be useful in liquidation issues

-

We can use this method for both equity value and enterprise value, but only if there is no equity involved.

-

Even though this method considers the assets and liabilities for valuation, it gives flexibility in deciding the assets and liabilities to consider for valuation. Also, it gives flexibility regarding how to measure the value of each.

11.5 Disadvantages of Asset Based Approach

-

it does not consider the future earning potential of the business.

-

In reality, a business may fail to fetch the value it gets on the basis of asset based method when it actually goes for disposing of its assets.

-

As said above, some off balance sheet items may also need to be considered in this method. So, measuring those items could get difficult.

-

This method of valuation may sound simple. But it actually needs a great level of experience, accuracy, and attention to come up with the right valuation. Therefore, in absence of proper data and experience, many companies may not be able to get the accurate valuation.

-

Intangibles (trade secrets) that a company would not want to value also gets valued in this approach. Valuing such intangibles could also become a challenge for the company.

-

Making market value adjustments to liabilities could raise or deflate the value of liabilities. And, this would eventually impact the adjusted net assets calculation.