The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement.

A balance sheet gives a snapshot of your financials at a particular moment, incorporating every journal entry since your company launched. It shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity).

Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position. Companies usually prepare one at the end of a reporting period, such as a month, quarter, or year.

The Purpose of the Balance Sheet

A balance sheet provides a summary of a business at a given point in time. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Balance sheets serve two very different purposes depending on the audience reviewing them.

When a balance sheet is reviewed internally by a business leader, key stakeholder, or employee, it’s designed to give insight into whether a company is succeeding or failing. Based on this information, an internal audience can shift their policies and approach: doubling down on successes, correcting failures, and pivoting toward new opportunities.

When a balance sheet is reviewed externally by someone interested in a company, it’s designed to give insight into what resources are available to a business and how they were financed. Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio.

Why Is a Balance Sheet Important?

A balance sheet is an important financial statement that gives a snapshot of the financial health of your business at a point in time. You can also look at your balance sheet in conjunction with your other financial statements. This way, you can better understand the relationships between different accounts.

Here’s a closer look at what’s typically included in each of those categories of value: assets, liabilities, and owners’ equity.

Assets- the things your business owns that have a dollar value. List your assets in order of liquidity, or how easily they can be turned into cash, sold or consumed. Anything you expect to convert into cash within a year is called current assets.

Current assets include

Money in a checking account

Money in transit (money being transferred from another account)

Accounts receivable (money owed to you by customers)

Short-term investments

Inventory

Prepaid expenses

Cash equivalents (currency, stocks, and bonds)

Long-term assets, on the other hand, are things you don’t plan to convert to cash within a year.

Long-term assets include

Buildings and land

Machinery and equipment (less accumulated depreciation)

Intangible assets like patents, trademarks, and goodwill (you would list the market value of what fair price a buyer might purchase these for)

Long-term investments

Liabilities- A liability is the opposite of an asset. While an asset is something a company owns, a liability is something it owes. Liabilities are financial and legal obligations to pay an amount of money to a debtor, which is why they’re typically tallied as negatives (-) in a balance sheet.

Just as assets are categorized as current or noncurrent, liabilities are categorized as current liabilities or noncurrent liabilities.

Current liabilities typically refer to any liability due to the debtor within one year, which may include:

Payroll expenses

Rent payments

Utility payments

Debt financing

Accounts payable

Other accrued expenses

Noncurrent liabilities typically refer to any long-term obligations or debts which will not be due within one year, which might include:

Leases

Loans

Bonds payable

Provisions for pensions

Deferred tax liabilities

Equity

Equity is money currently held by your company. (This category is usually called “owner’s equity” for sole proprietorships and “stockholders’ equity” for corporations.) It shows what belongs to the business owners.

Owners’ equity includes-

Capital (money invested into the business by the owners)

Private or public stock

Retained earnings (all your revenue minus all your expenses since launch)

Equity can also drop when an owner draws money out of the company to pay them, or when a corporation issues dividends to shareholders.

For where’s the Beef, let’s say you invested Rs 2,500 to launch the business in 2016 and another Rs 2,500 a year later. Since then, you’ve taken Rs 9,000 out of the business to pay yourself and you’ve left some profit in the bank.

Example/ format of balance sheet

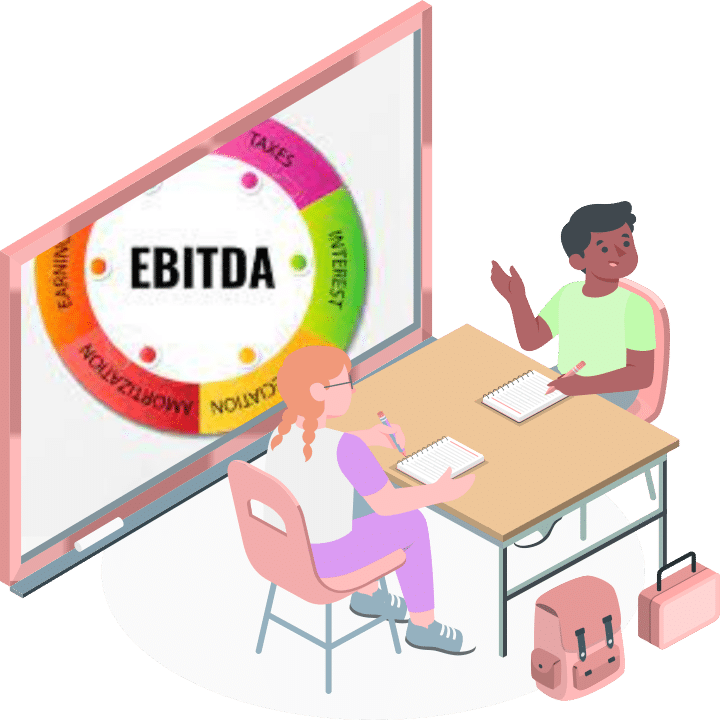

Short Understanding

The information found in a company’s balance sheet is among some of the most important for a business leader, regulator, or potential investor to understand. Without this knowledge, it can be challenging to know whether a company is struggling or thriving, highlighting why learning how to read and understand a balance sheet is a crucial skill for anyone interested in business.